Strategic forecasting tools are essential for businesses navigating an increasingly complex and dynamic environment. These tools provide a structured approach to analyzing historical data, identifying trends, and predicting future outcomes. Understanding the various methodologies, data requirements, and interpretation techniques associated with these tools is crucial for making informed, data-driven decisions that drive business success. This guide explores the diverse landscape of strategic forecasting tools, offering a practical understanding of their applications and limitations.

From qualitative methods like expert panels to quantitative approaches such as time series analysis and regression modeling, the options are plentiful. The choice of the right tool depends heavily on the specific business context, the available data, and the desired level of accuracy. We’ll examine several popular tools, comparing their strengths and weaknesses to help you select the best fit for your needs. We’ll also delve into the critical aspects of data quality, interpretation of results, and the ethical considerations of employing advanced forecasting technologies.

Defining Strategic Forecasting Tools

Strategic forecasting tools are essential for organizations aiming to anticipate future trends and make informed decisions. They encompass a range of techniques and software designed to analyze historical data, identify patterns, and project potential outcomes. Effective utilization of these tools allows businesses to proactively adapt to changing market conditions, optimize resource allocation, and ultimately enhance their competitive advantage.

Strategic forecasting tools analyze both qualitative and quantitative data to predict future events. The core functionality revolves around data processing, model building, and scenario planning, ultimately providing insights to support strategic decision-making. The sophistication of these tools varies widely, ranging from simple spreadsheet models to complex simulation software.

Categorization of Strategic Forecasting Tools

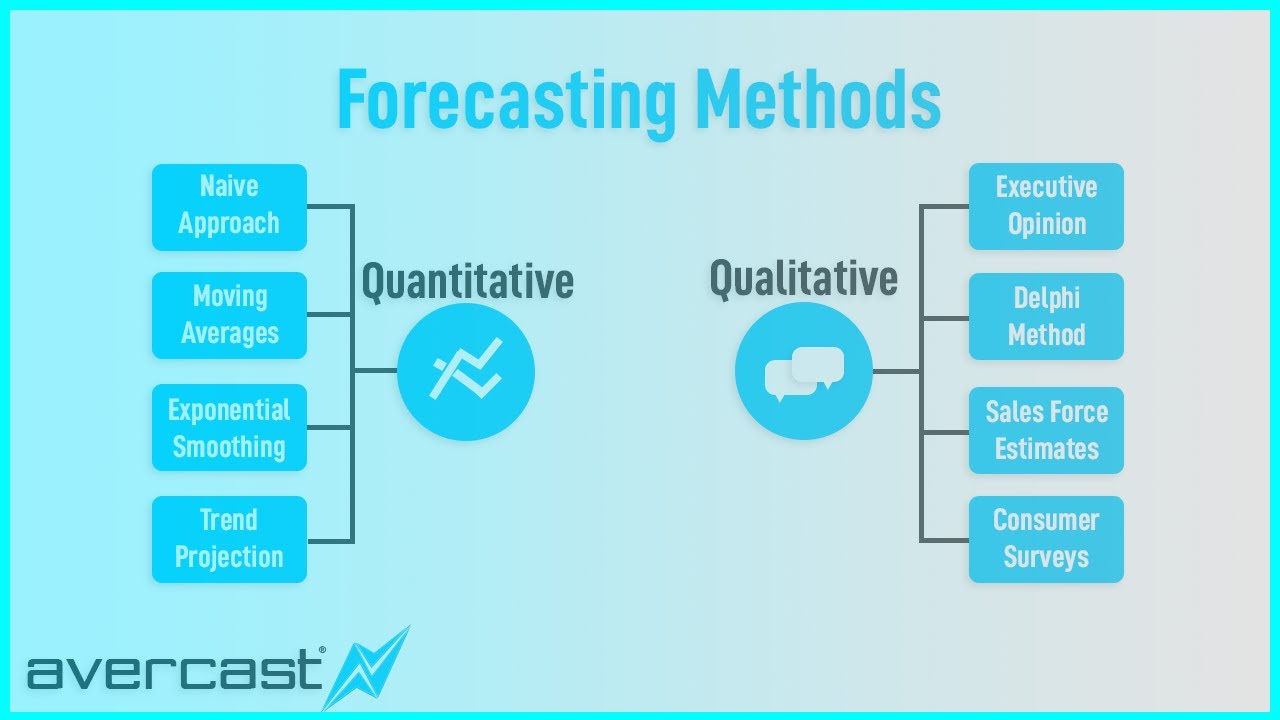

Strategic forecasting tools can be broadly classified into qualitative and quantitative methods. Qualitative methods rely on expert judgment, intuition, and subjective assessments. Examples include the Delphi method, which aggregates expert opinions through iterative questionnaires, and scenario planning, which involves developing plausible future scenarios based on various factors. Quantitative methods, conversely, utilize statistical analysis and mathematical models to predict future outcomes. These include time series analysis (e.g., ARIMA models), regression analysis, and causal forecasting models. The choice between qualitative and quantitative methods often depends on the nature of the problem, the availability of data, and the desired level of precision.

Comparison of Popular Strategic Forecasting Tools

A comparison of three popular strategic forecasting tools – Microsoft Excel, IBM SPSS Modeler, and SAS Forecasting – reveals their varying strengths and weaknesses.

| Tool | Strengths | Weaknesses |

|---|---|---|

| Microsoft Excel | Widely accessible, relatively inexpensive, user-friendly interface, suitable for simple forecasting models (e.g., moving averages). | Limited statistical capabilities compared to dedicated forecasting software, prone to errors with complex models, scalability issues with large datasets. |

| IBM SPSS Modeler | Powerful statistical capabilities, handles large datasets efficiently, supports a wide range of forecasting techniques (including time series analysis and machine learning algorithms), offers advanced visualization tools. | Steeper learning curve compared to Excel, relatively expensive, requires specialized training. |

| SAS Forecasting | Highly sophisticated forecasting capabilities, integrates well with other SAS products, robust error handling, extensive documentation and support. | Very expensive, complex interface, requires significant expertise to use effectively. |

For instance, a small business might find Excel sufficient for basic sales forecasting, while a large multinational corporation might require the advanced capabilities of SAS Forecasting for complex supply chain optimization. The choice ultimately depends on the specific needs and resources of the organization.

Data Requirements for Effective Forecasting: Strategic Forecasting Tools

Accurate strategic forecasting hinges on the availability and quality of relevant data. The types of data needed vary depending on the specific forecasting objective, but generally encompass both internal and external sources, covering historical trends, current market conditions, and future projections. The more comprehensive and reliable the data, the more accurate and valuable the resulting forecasts will be.

Types of Data Needed for Accurate Strategic Forecasting

Strategic forecasting requires a multifaceted approach to data collection. This includes quantitative data, providing measurable insights into past performance and current market dynamics, and qualitative data, offering valuable context and insights into less easily quantifiable factors. Quantitative data might include sales figures, market share, economic indicators, and production costs. Qualitative data might encompass customer feedback, competitor analysis, technological advancements, and regulatory changes. The combination of these data types allows for a more nuanced and comprehensive understanding of the factors influencing future outcomes.

Data Collection Plan for a Specific Business Scenario

Consider a coffee shop chain aiming to forecast sales for the next quarter. Their data collection plan should include:

- Past sales data: Daily, weekly, and monthly sales figures for the past two years, broken down by location, product, and time of day. This provides a baseline for trend analysis.

- Customer demographics: Data on customer age, location, purchase frequency, and preferred products, obtained through loyalty programs and point-of-sale systems. This helps segment the customer base and tailor marketing efforts.

- Economic indicators: Local unemployment rates, consumer confidence indices, and inflation rates, sourced from government agencies and economic research firms. These provide context for broader economic trends impacting consumer spending.

- Competitor analysis: Information on competitor pricing, promotions, and new product launches, gathered through market research and observation. This helps assess market share and competitive pressures.

- Weather data: Daily temperature and precipitation data, obtained from meteorological services. This can influence foot traffic and sales, especially for a business reliant on outdoor seating.

Importance of Data Quality and its Impact on Forecast Accuracy

Data quality is paramount for reliable forecasting. Inaccurate, incomplete, or inconsistent data can lead to flawed predictions and poor decision-making. Data quality issues such as missing values, outliers, and measurement errors can significantly distort the results of forecasting models. For example, if sales data is missing for certain periods or contains errors, the resulting forecast will be unreliable. Similarly, using outdated or irrelevant data can lead to inaccurate predictions. Robust data validation and cleaning processes are crucial to ensuring data accuracy and reliability.

Data Sources, Reliability, and Potential Biases

| Data Source | Reliability | Potential Biases |

|---|---|---|

| Internal Sales Records | High (if properly maintained) | Potential for recording errors; may not capture all sales (e.g., unrecorded cash transactions) |

| Customer Surveys | Moderate (depends on sample size and survey design) | Response bias; may not represent the entire customer base accurately |

| Government Economic Statistics | High | Potential for lag in reporting; may not reflect local economic conditions perfectly |

| Competitor Websites and Reports | Moderate to Low (depends on the source) | Information may be incomplete or outdated; potential for bias in self-reported data |

Methodologies Employed in Strategic Forecasting

Strategic forecasting relies on a variety of methodologies to predict future trends and outcomes. The choice of methodology depends heavily on the specific business context, the type of data available, and the desired level of accuracy. Understanding the strengths and weaknesses of each approach is crucial for effective forecasting.

Time Series Analysis

Time series analysis utilizes historical data points collected over time to identify patterns and trends. These patterns, which might include seasonality, trends, or cyclical fluctuations, are then extrapolated into the future to generate forecasts. Methods like moving averages, exponential smoothing, and ARIMA models are commonly employed. For example, a retailer might use time series analysis to predict sales for the upcoming holiday season based on past sales data. A limitation of time series analysis is its reliance on the assumption that past patterns will continue into the future, which may not always hold true in rapidly changing market conditions. To mitigate this, incorporating external factors and qualitative insights can enhance the accuracy of the forecast.

Regression Analysis

Regression analysis explores the relationship between a dependent variable (the variable being predicted) and one or more independent variables (factors influencing the dependent variable). By identifying these relationships, regression models can be used to predict the value of the dependent variable based on the values of the independent variables. For instance, a company might use regression analysis to predict sales based on factors like advertising spend, price, and competitor activity. A key limitation is the potential for multicollinearity (high correlation between independent variables), which can make it difficult to isolate the individual effects of each variable. Careful variable selection and data preprocessing techniques can help address this issue.

Simulation

Simulation involves creating a computer model of a system to test different scenarios and predict outcomes. This approach is particularly useful for complex systems with multiple interacting variables where analytical methods may be insufficient. Monte Carlo simulation, for example, uses random sampling to model uncertainty and generate a range of possible outcomes. A manufacturing company might use simulation to model the impact of different production schedules on overall efficiency and costs. A major limitation is the complexity and computational cost of building and running simulations, and the accuracy of the results depends heavily on the accuracy of the underlying model. Rigorous model validation and sensitivity analysis are essential to ensure reliable results.

Flowchart: Applying Exponential Smoothing (a Time Series Method)

The following flowchart illustrates the steps involved in applying exponential smoothing, a common time series forecasting technique:

[Imagine a flowchart here. The flowchart would start with “Gather Historical Data,” then proceed to “Select Smoothing Constant (alpha),” then “Calculate Exponentially Smoothed Values,” then “Forecast Next Period’s Value,” then “Evaluate Forecast Accuracy,” and finally “Refine Model (if necessary).”] The flowchart visually represents the iterative process of applying exponential smoothing, starting with data collection and culminating in model refinement based on accuracy evaluation. Each step involves specific calculations and considerations detailed in statistical textbooks and software documentation. The smoothing constant (alpha) is a crucial parameter that controls the weight given to recent data versus older data in the forecast.

Interpreting and Utilizing Forecast Results

Strategic forecasting tools provide valuable insights, but their effectiveness hinges on accurately interpreting the outputs and translating them into actionable strategies. Understanding the nuances of different forecasting methodologies and acknowledging inherent uncertainties are crucial for informed decision-making. This section explores the process of interpreting forecast results, incorporating uncertainty, and communicating findings effectively to various stakeholders.

Interpreting Forecast Outputs from Different Tools

Different forecasting tools generate outputs in various formats. Quantitative methods, such as time series analysis or regression models, often produce numerical forecasts with associated confidence intervals. Qualitative methods, like Delphi techniques or scenario planning, may yield more descriptive outcomes, outlining potential future scenarios and their likelihoods. Interpreting these outputs requires understanding the underlying methodology and its limitations. For example, a time series forecast might show a projected 10% increase in sales next quarter with a 95% confidence interval of 5% to 15%. This indicates a high probability of sales growth, but also acknowledges the potential for variation. In contrast, a scenario planning exercise might identify three potential future market conditions: high growth, stable growth, and decline, each with assigned probabilities. Understanding these different formats is key to accurate interpretation.

Translating Forecast Results into Actionable Business Strategies

Forecast results should not be simply reported; they should inform strategic decisions. A sales forecast predicting a significant increase in demand, for instance, could trigger actions like increasing production capacity, hiring additional staff, or securing additional raw materials. Conversely, a forecast indicating a potential market downturn might lead to cost-cutting measures, product diversification, or investment in research and development to explore new opportunities. A marketing forecast showing a growing preference for online channels might lead to increased investment in digital marketing campaigns and a shift away from traditional methods. The key is to align business strategies with the insights revealed by the forecasts. For example, if a forecast predicts a shortage of a specific component for a product, the business can proactively secure alternative suppliers or explore substitute components.

Incorporating Forecast Uncertainty into Decision-Making

No forecast is perfect. All forecasting methods involve some degree of uncertainty. Effective decision-making requires acknowledging and incorporating this uncertainty. This can be done by using scenario planning to explore different potential outcomes or by using sensitivity analysis to assess how changes in key assumptions impact the forecast. For example, a company might develop three scenarios: a best-case, a base-case, and a worst-case scenario, each with different sales projections and corresponding strategies. This allows for contingency planning and adaptation to unforeseen circumstances. Using probabilistic forecasts, which provide a range of possible outcomes with associated probabilities, can also aid in incorporating uncertainty.

Communicating Forecast Results to Stakeholders

Effective communication of forecast results is crucial for organizational alignment and buy-in. The communication strategy should be tailored to the audience. For senior management, a concise summary highlighting key findings and strategic implications is sufficient. For operational teams, more detailed information on specific forecasts and their implications for their respective areas might be necessary. Visual aids such as charts and graphs can enhance understanding and engagement. Transparency about the limitations of the forecast and the assumptions made is also important to build trust and credibility. Regular updates and feedback loops can further improve communication and ensure that the forecasts remain relevant and actionable. For example, a monthly sales forecast could be presented to the sales team with a breakdown by region and product, while a yearly forecast summarizing overall sales and profitability could be presented to the board of directors.

Case Studies of Strategic Forecasting Applications

Strategic forecasting, when effectively implemented, can significantly impact a business’s trajectory. Analyzing real-world applications and hypothetical scenarios helps illustrate its power and the challenges involved in its successful deployment. This section examines case studies demonstrating both the benefits and complexities of incorporating strategic forecasting into business decision-making.

Netflix’s Content Strategy and Forecasting

Netflix’s success is significantly tied to its sophisticated content forecasting. They leverage vast amounts of user data—viewing habits, ratings, search queries, and more—to predict audience preferences and inform their content creation and acquisition strategies. This involves complex algorithms and machine learning models that analyze patterns and trends to forecast the potential success of different shows and movies. This data-driven approach allows them to minimize risk by investing in projects with a higher probability of success and optimize their content library to maximize viewer engagement and retention. For example, their investment in international programming was partly driven by forecasts indicating significant growth potential in non-US markets. This strategic forecasting has been instrumental in Netflix’s global expansion and dominance in the streaming industry.

Hypothetical Scenario: Sales Forecasting for a New Product Launch

Imagine a new tech startup launching a smart home device. They utilize a time series forecasting model, specifically ARIMA (Autoregressive Integrated Moving Average), to predict sales for the first year. The ARIMA model takes into account historical sales data of similar products, seasonality (e.g., higher sales during holiday seasons), and external factors like economic indicators. By inputting relevant data, the model generates a sales forecast that helps the company determine optimal production levels, marketing budget allocation, and staffing needs. If the forecast predicts high initial demand, the company can secure sufficient manufacturing capacity and proactively address potential supply chain challenges. Conversely, a lower-than-expected forecast might lead to a more conservative marketing strategy and adjusted production plans.

Challenges in Implementing Strategic Forecasting at a Retail Chain

Consider a large retail chain attempting to implement strategic forecasting for inventory management. One major challenge is data integration. The company might have data scattered across various systems (point-of-sale, supply chain, customer relationship management), making it difficult to create a unified and reliable dataset for forecasting. Another hurdle is the accuracy of the forecasting models themselves. External factors such as economic downturns, unexpected weather events, or competitor actions can significantly impact sales, making accurate predictions challenging. Furthermore, resistance to change within the organization can hinder the adoption and successful implementation of new forecasting techniques. Finally, ensuring that the forecast results are effectively communicated and understood across different departments is critical for successful implementation.

Key Lessons Learned from Case Studies

The following points summarize key lessons from the analyzed case studies:

- Data quality is paramount. Accurate and comprehensive data is crucial for reliable forecasts.

- Choosing the right forecasting methodology is vital. The best approach depends on the specific business problem and available data.

- Effective communication and collaboration are essential. Forecasting results need to be understood and acted upon by all relevant stakeholders.

- Regular monitoring and evaluation are necessary. Forecasts should be continuously reviewed and adjusted based on actual results.

- Consider external factors. Economic conditions, competitor actions, and unexpected events can significantly impact forecasts.

Technological Advancements in Strategic Forecasting

The integration of advanced technologies, particularly artificial intelligence (AI) and machine learning (ML), is revolutionizing strategic forecasting. These advancements are leading to more accurate, efficient, and insightful predictions across various sectors, impacting decision-making at the highest levels. This section will explore the significant role of these technologies and examine the emerging trends and ethical considerations they present.

The Impact of Artificial Intelligence and Machine Learning on Strategic Forecasting

AI and ML algorithms are transforming the way businesses and organizations approach forecasting. These technologies excel at processing vast datasets, identifying complex patterns and relationships often missed by traditional methods, and generating more accurate predictions. For example, ML models can analyze historical sales data, economic indicators, social media sentiment, and even weather patterns to forecast future demand with greater precision than ever before. Furthermore, AI-powered systems can adapt and learn from new data, constantly refining their predictive capabilities over time. This continuous learning aspect is particularly valuable in dynamic environments where market conditions and customer behavior are subject to rapid change. A company using AI for demand forecasting, for instance, could significantly reduce inventory costs and improve customer satisfaction by accurately predicting fluctuations in demand.

AI-Driven Forecasting Methodologies

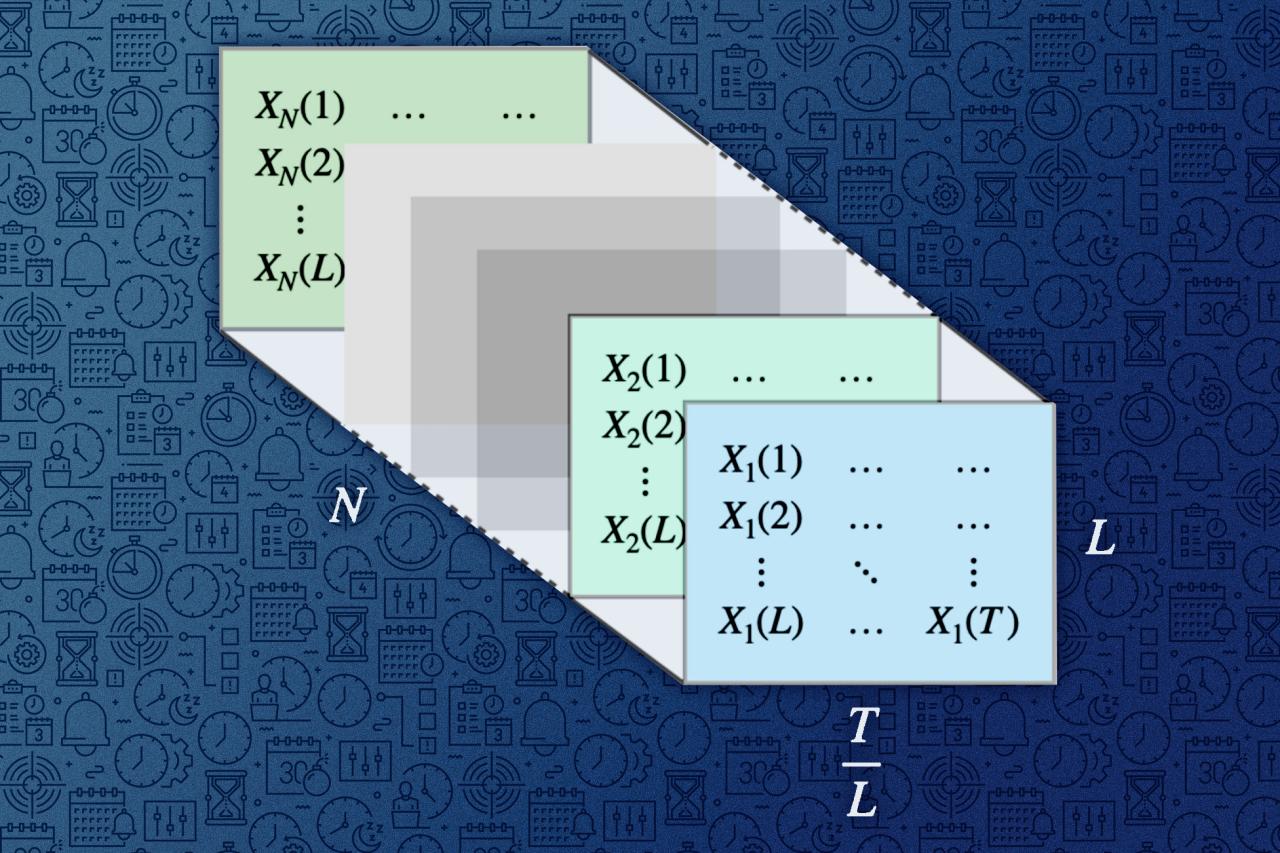

Several specific AI and ML methodologies are being employed in strategic forecasting. These include time series analysis using techniques like ARIMA and LSTM networks, which are adept at identifying temporal dependencies in data; regression models that consider multiple influencing factors; and classification algorithms that help categorize and predict categorical outcomes. These methodologies allow forecasters to move beyond simple linear extrapolations and incorporate nuanced insights from complex datasets. For instance, an LSTM network, a type of recurrent neural network, could be used to forecast stock prices by analyzing historical price data, news sentiment, and other relevant economic indicators. The network’s ability to handle sequential data makes it particularly suitable for this type of time-series prediction.

Emerging Trends in Strategic Forecasting Tools and Technologies

The field of strategic forecasting is witnessing the rapid development of several new tools and technologies. Cloud-based platforms are providing scalable and cost-effective solutions for data storage, processing, and model deployment. The integration of big data analytics is enabling forecasters to leverage massive datasets from various sources, improving the comprehensiveness and accuracy of their predictions. Furthermore, the development of explainable AI (XAI) is addressing the “black box” problem associated with some complex ML models, increasing transparency and trust in the forecasting process. These advancements are making sophisticated forecasting techniques more accessible and easier to interpret, even for non-experts.

Examples of Improved Accuracy and Efficiency, Strategic forecasting tools

The application of new technologies is demonstrably improving the accuracy and efficiency of strategic forecasting. In the retail sector, AI-powered demand forecasting systems are helping retailers optimize inventory levels, reduce waste, and personalize customer experiences. In the financial industry, AI algorithms are being used to predict market trends, manage risk, and detect fraudulent activities. In the healthcare sector, AI is assisting in predicting disease outbreaks and optimizing resource allocation. These are just a few examples of how new technologies are transforming decision-making across various industries. A specific example is the improved accuracy of weather forecasting, where advanced models now incorporate satellite imagery, radar data, and atmospheric simulations to provide more precise and timely predictions, impacting everything from agriculture to aviation.

Ethical Considerations of Advanced Forecasting Technologies

While the benefits of advanced forecasting technologies are substantial, it’s crucial to acknowledge the potential ethical considerations. Bias in training data can lead to biased forecasts, perpetuating existing inequalities. The potential for misuse of predictive models, such as in discriminatory lending practices or surveillance, requires careful attention. Furthermore, the opacity of some AI models can make it difficult to understand the reasoning behind their predictions, raising concerns about accountability and transparency. Therefore, responsible development and deployment of these technologies, including robust data governance and ethical guidelines, are paramount.

Visualizing Forecast Data

Effective visualization is crucial for transforming complex forecast data into actionable insights. Clear and concise visuals facilitate understanding, enabling stakeholders to grasp key trends and make informed decisions. Without effective visualization, even the most accurate forecast can be misinterpreted or overlooked.

Visualizing forecast data involves selecting appropriate chart types to highlight specific aspects of the data, crafting compelling narratives to contextualize the findings, and strategically emphasizing key trends and insights. The goal is to create a clear and persuasive communication piece that facilitates decision-making.

Chart Selection for Forecast Data

The choice of chart type depends heavily on the data being presented and the message intended. Different chart types emphasize different aspects of the data, making some more suitable than others for specific forecasting tasks. For example, a line chart is ideal for showing trends over time, while a bar chart is better for comparing different categories.

| Chart Type | Best Use Case | Example | Description |

|---|---|---|---|

| Line Chart | Showing trends over time | Illustrating sales projections over the next 12 months. | A line chart effectively displays the upward or downward trend of sales, allowing for easy identification of growth or decline periods. |

| Bar Chart | Comparing different categories | Comparing projected market share across different product lines. | A bar chart visually represents the market share of each product line, facilitating a quick comparison of their relative performance. Longer bars indicate larger market shares. |

| Scatter Plot | Showing correlations between variables | Analyzing the relationship between advertising spend and sales revenue. | A scatter plot illustrates the relationship between advertising expenditure and resulting sales. Clustering of points suggests a correlation, while a dispersed pattern indicates a weak relationship. |

| Area Chart | Highlighting cumulative values over time | Showing the cumulative number of new customers acquired over a year. | An area chart displays the total number of new customers accumulated over time. The area under the curve represents the cumulative value, allowing for easy visualization of growth. |

Creating Compelling Narratives

A compelling narrative transforms data points into a story that resonates with the audience. This involves more than simply presenting the charts; it requires contextualizing the data within the larger business context, highlighting key takeaways, and explaining any potential implications. For example, a forecast showing declining sales might be contextualized by discussing external factors such as economic downturns or increased competition.

Highlighting Key Trends and Insights

Visual aids should not simply present data; they should highlight key findings. This can be achieved through techniques such as using color-coding to emphasize specific data points, adding annotations to explain significant trends, and strategically using labels and titles to focus attention on critical information. For example, a significant increase in sales could be highlighted with a bold line and an annotation.

Concluding Remarks

Mastering strategic forecasting tools empowers businesses to anticipate challenges, capitalize on opportunities, and make proactive decisions that drive sustainable growth. By understanding the methodologies, data requirements, and interpretation techniques, organizations can leverage the power of predictive analytics to gain a competitive edge. This guide has provided a framework for understanding and implementing these crucial tools, encouraging a data-driven approach to strategic planning and ultimately, improved business outcomes. The successful application of these tools hinges on a combination of technical proficiency, sound judgment, and a clear understanding of the business context.

Strategic forecasting tools are invaluable for anticipating future trends. Understanding factors like weather patterns, for example, is crucial; consider the impact on a sport like beach volleyball, where conditions heavily influence gameplay. To illustrate, check out this resource on Permainan bola voli pantai to see how environmental factors play a significant role. Ultimately, effective strategic forecasting incorporates such diverse variables for a more comprehensive outlook.

Strategic forecasting tools are crucial for navigating the complexities of modern markets. Understanding future trends is vital, and this is particularly true when implementing Growth-focused business models , which often require significant upfront investment and a clear vision of long-term potential. Effective forecasting allows businesses to proactively adjust strategies and mitigate risks associated with ambitious growth targets.