Mobile payment options are rapidly transforming how we conduct transactions, offering convenience and speed previously unimaginable. From contactless NFC taps to scanning QR codes and utilizing digital wallets, the methods are diverse and constantly evolving. This exploration delves into the various systems, security measures, global adoption trends, and the future implications of this increasingly prevalent technology.

Understanding the nuances of different mobile payment systems, including their underlying technologies and security protocols, is crucial for both consumers and businesses. This guide will examine the advantages and disadvantages of each approach, while also considering the impact on traditional payment methods and the evolving regulatory landscape.

Types of Mobile Payment Systems

Mobile payment systems have revolutionized how we conduct transactions, offering convenience, speed, and security. These systems leverage various technologies to facilitate seamless payments through smartphones and other mobile devices. Understanding the different types and their underlying technologies is crucial for both consumers and businesses.

NFC-Based Payments

Near Field Communication (NFC) technology enables contactless payments by transmitting data wirelessly over short distances. An NFC-enabled device, such as a smartphone or smartwatch, is held near a contactless payment terminal to complete the transaction. The process is quick and secure, relying on cryptographic techniques to protect transaction data. Examples of NFC-based payment systems include Apple Pay, Google Pay, and Samsung Pay, which are widely used in North America, Europe, and parts of Asia. The underlying technology involves the exchange of encrypted payment information between the device and the terminal, using secure elements within the device to safeguard sensitive data.

QR Code Payments

QR code payments utilize two-dimensional barcodes that contain transaction information. Users scan the QR code with their smartphone camera, typically through a dedicated mobile payment app. The app then processes the payment, often linking to a bank account or a mobile wallet. This method is particularly popular in Asia, with Alipay and WeChat Pay dominating the Chinese market. In other regions, QR code payments are gaining traction as a convenient and cost-effective alternative to traditional card payments. The underlying technology involves the generation and scanning of QR codes, along with secure communication channels between the payment app and the merchant’s system.

Mobile Wallets

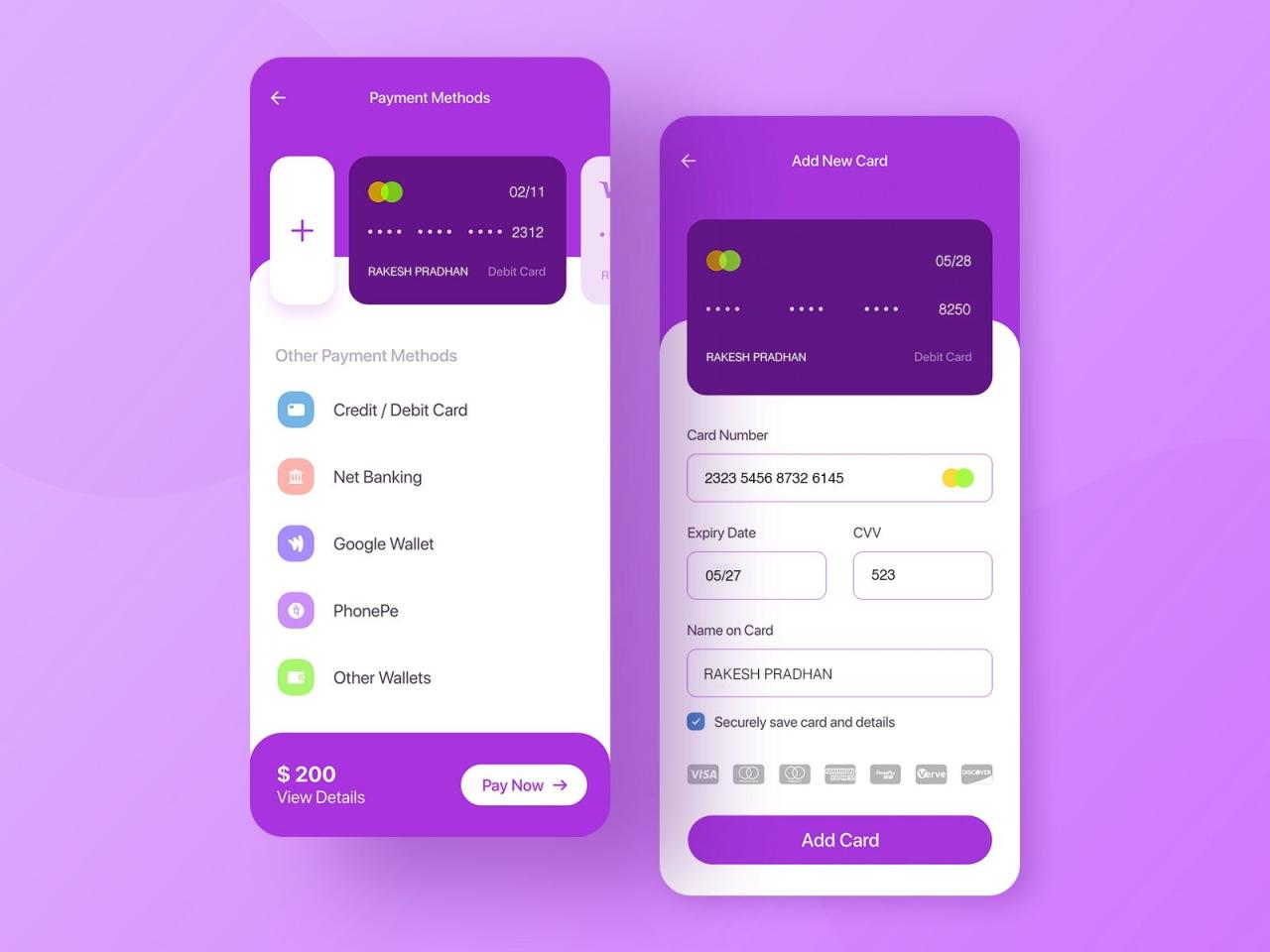

Mobile wallets are digital versions of physical wallets, storing payment information, loyalty cards, and other digital credentials. They can support various payment methods, including NFC, QR codes, and online payments. Examples include Apple Wallet, Google Wallet, and PayPal. Mobile wallets offer a centralized platform for managing various payment instruments and accessing related services. The underlying technology encompasses secure storage of payment information, encryption, and integration with various payment gateways and service providers. Many mobile wallets use tokenization, replacing sensitive card details with unique tokens for enhanced security.

Comparison of Security Features

The security of different mobile payment methods varies depending on the specific implementation and underlying technologies. While all strive for robust security, differences exist in the approaches taken.

| Payment Method | Tokenization | Biometric Authentication | Transaction Encryption |

|---|---|---|---|

| NFC-based (Apple Pay, Google Pay) | Yes | Often (fingerprint, Face ID) | Yes |

| QR Code Payments (Alipay, WeChat Pay) | Often | May vary | Yes |

| Mobile Wallets (PayPal, Apple Wallet) | Often | Often (fingerprint, PIN) | Yes |

Security and Privacy Concerns

The convenience of mobile payments comes with inherent security and privacy risks. Users need to be aware of these potential vulnerabilities and take proactive steps to protect their financial information. Failure to do so can lead to significant financial losses and identity theft. Understanding the mechanisms used to secure transactions and adopting best practices is crucial for safe mobile payment usage.

Mobile payment systems, while generally secure, are not immune to fraud and data breaches. Phishing scams, malware infections, and vulnerabilities within the payment apps themselves can expose user data, including sensitive financial information and personal details. Data breaches affecting payment processors or mobile network operators can also compromise user accounts. The potential consequences range from unauthorized transactions and account takeover to identity theft and reputational damage.

Mobile Payment Security Risks

The risks associated with mobile payments encompass a wide range of threats. Malicious apps disguised as legitimate payment applications can steal credentials and financial data. Phishing attempts, often via text messages or emails, trick users into revealing their login details or credit card information. Network vulnerabilities can allow attackers to intercept transactions. Furthermore, compromised devices, whether through lost or stolen phones or malware infections, provide direct access to payment applications and stored financial information. Finally, vulnerabilities in the payment systems themselves, though rare, can be exploited by sophisticated attackers.

Best Practices for Secure Mobile Payment Usage

Protecting financial information during mobile payments requires a multi-layered approach. Users should only download payment apps from official app stores to minimize the risk of malware. Strong, unique passwords should be used for each payment app and regularly updated. Enabling biometric authentication, such as fingerprint or facial recognition, adds an extra layer of security. Users should regularly review their transaction history for any unauthorized activity and report suspicious transactions immediately. Furthermore, keeping mobile devices updated with the latest security patches is essential to mitigate vulnerabilities. Avoiding using public Wi-Fi for mobile payments whenever possible reduces the risk of network interception.

The Role of Encryption and Tokenization

Encryption and tokenization are key technologies used to secure mobile payment transactions. Encryption transforms sensitive data into an unreadable format, protecting it during transmission and storage. Tokenization replaces sensitive data, such as credit card numbers, with unique, non-sensitive tokens. These tokens are used for transactions, while the actual sensitive data remains protected. This means that even if a data breach occurs, the stolen tokens are useless to attackers without access to the decryption key or the tokenization system’s mapping. A combination of strong encryption algorithms and robust tokenization systems significantly reduces the risk of data compromise and unauthorized access.

User Guide for Secure Mobile Payment Practices

This guide Artikels essential steps for secure mobile payment usage:

- Download payment apps only from official app stores (Google Play Store, Apple App Store).

- Create strong, unique passwords for each payment app and change them regularly.

- Enable biometric authentication (fingerprint, facial recognition) whenever available.

- Regularly review your transaction history for unauthorized activity.

- Report suspicious transactions to your bank or payment provider immediately.

- Keep your mobile device software updated with the latest security patches.

- Avoid using public Wi-Fi for mobile payments.

- Be cautious of phishing attempts via text messages or emails.

- Use a reputable antivirus and anti-malware solution on your device.

- Consider using a virtual private network (VPN) when using public Wi-Fi.

Mobile Payment Adoption and Trends

The global landscape of mobile payments is experiencing explosive growth, driven by technological advancements, shifting consumer preferences, and supportive regulatory environments. Understanding the factors influencing this adoption, along with the varying rates across demographics and regions, is crucial for businesses and policymakers alike. This section will explore the key drivers, disparities in adoption, and the impact of government regulations on the mobile payment industry.

Factors Driving Global Mobile Payment Growth

Several interconnected factors are fueling the rapid expansion of mobile payment systems worldwide. Increased smartphone penetration, particularly in developing economies, provides a readily available platform for mobile transactions. The rise of e-commerce and online shopping has created a significant demand for convenient and secure payment methods beyond traditional credit cards. Furthermore, the development of user-friendly mobile payment apps and services, often integrated with existing financial platforms, has significantly lowered the barrier to entry for consumers. Finally, the increasing prevalence of contactless payment technologies, such as near-field communication (NFC), enables quick and seamless transactions. These factors, acting in concert, are driving the global shift towards mobile payments.

Demographic and Geographic Variations in Mobile Payment Adoption

Mobile payment adoption rates vary significantly across different demographics and geographic locations. In developed nations, particularly in regions with high smartphone penetration and robust digital infrastructure, adoption rates are generally high. For instance, countries like South Korea and China boast exceptionally high rates of mobile payment usage, driven by a combination of technological innovation and government support. However, in developing countries, adoption rates may be lower due to factors such as limited smartphone access, lower levels of financial literacy, and concerns about security. Younger demographics tend to show higher adoption rates compared to older generations, reflecting a greater familiarity and comfort level with technology. This disparity highlights the need for targeted strategies to promote financial inclusion and bridge the digital divide.

Impact of Government Regulations on the Mobile Payment Industry

Government regulations play a crucial role in shaping the mobile payment landscape. Regulations concerning data privacy, consumer protection, and anti-money laundering (AML) compliance are essential for building trust and security in the system. Supportive regulatory frameworks can encourage innovation and competition, leading to a more vibrant and efficient mobile payment ecosystem. Conversely, overly restrictive regulations can stifle innovation and limit the growth potential of the industry. For example, some governments actively promote the development of mobile payment infrastructure through subsidies or tax incentives, while others may impose stringent licensing requirements that hinder market entry. The impact of government policies is therefore a significant factor influencing the trajectory of mobile payment adoption.

Key Trends in Mobile Payment Technology

The mobile payment industry is constantly evolving, with several key trends shaping its future.

- Increased use of biometrics: Fingerprint and facial recognition technologies are increasingly integrated into mobile payment systems, enhancing security and convenience.

- Growth of super apps: Integrated platforms offering a wide range of services, including mobile payments, are gaining popularity, providing a one-stop shop for consumers.

- Expansion of contactless payments: NFC technology is becoming ubiquitous, enabling quick and easy transactions at physical points of sale.

- Blockchain and cryptocurrency integration: The integration of blockchain technology and cryptocurrencies is slowly gaining traction, potentially revolutionizing the way payments are processed.

- Rise of embedded finance: The integration of financial services within non-financial applications, such as e-commerce platforms, is increasing the accessibility and convenience of mobile payments.

Merchant Acceptance and Integration

Integrating mobile payment options presents both opportunities and challenges for merchants. The ability to accept diverse payment methods enhances customer experience and potentially boosts sales. However, merchants must navigate technical complexities, security concerns, and the costs associated with adopting new technologies. This section explores these aspects of mobile payment integration for businesses.

Challenges of Mobile Payment Integration

Merchants face several hurdles when integrating mobile payment systems. One key challenge is the need to adapt existing point-of-sale (POS) systems to accommodate new payment gateways and protocols. This often requires software updates, hardware upgrades, or even complete system replacements. Another significant challenge is ensuring seamless integration with existing inventory management and accounting systems to maintain accurate sales tracking and financial records. Furthermore, merchants must grapple with the complexities of managing multiple payment processors, each with its own fees and settlement procedures. Finally, providing adequate staff training on the new payment systems is crucial for smooth operation and to avoid customer frustration.

Examples of POS Systems Supporting Mobile Payments

Many POS systems now offer comprehensive support for various mobile payment methods. Square, for instance, is a popular choice for small businesses, supporting Apple Pay, Google Pay, and other contactless payment options. Shopify POS offers similar functionality, integrating seamlessly with its e-commerce platform. Larger enterprises might use more sophisticated systems like Lightspeed or Toast, which provide robust features and often integrate with other business management tools. These systems typically handle transaction processing, security, and reporting, simplifying the mobile payment acceptance process for merchants.

Costs Associated with Accepting Mobile Payments

The cost of accepting mobile payments varies significantly depending on the chosen system and payment processor. Merchants typically incur transaction fees, which are usually a percentage of each transaction value plus a small per-transaction fee. There may also be monthly subscription fees for the POS system or payment gateway. Hardware costs, such as card readers or contactless payment terminals, can also be significant, particularly for businesses with multiple locations. Finally, businesses might incur costs associated with staff training and ongoing technical support. Careful evaluation of these costs is essential before selecting a mobile payment solution.

Setting Up Mobile Payment Acceptance for a Small Business

For a small business, setting up mobile payment acceptance typically involves these steps: First, choose a payment processor and POS system that suits their needs and budget. This decision involves considering factors such as transaction fees, supported payment methods, and integration capabilities. Next, sign up for an account with the chosen payment processor and provide necessary business information. The next step is to obtain the necessary hardware, such as a card reader or contactless payment terminal. After that, integrate the payment system with the existing POS system or install a new system entirely. Finally, train staff on how to use the new system and ensure they understand security protocols to prevent fraud. Many processors offer detailed setup guides and customer support to assist businesses throughout this process.

The Future of Mobile Payments

The mobile payment landscape is poised for significant transformation in the coming years, driven by advancements in technology and evolving consumer preferences. We’re moving beyond the simple transfer of funds to a more integrated and personalized experience, blurring the lines between online and offline transactions. This evolution presents both exciting opportunities and considerable challenges for businesses and consumers alike.

Emerging Technologies Shaping Mobile Payments

Several emerging technologies are set to revolutionize how we make mobile payments. Biometric authentication, such as fingerprint and facial recognition, is enhancing security and simplifying the checkout process, reducing reliance on passwords and PINs. Blockchain technology, with its inherent security and transparency, offers the potential for faster, cheaper, and more secure cross-border transactions, potentially disrupting existing payment rails. Artificial intelligence (AI) is playing an increasingly important role, enabling personalized offers, fraud detection, and improved customer service within mobile payment platforms. Near Field Communication (NFC) technology continues to be a cornerstone, enabling contactless payments, while advancements in 5G and improved mobile network infrastructure are facilitating faster and more reliable transactions.

Predictions for the Future Mobile Payment Landscape, Mobile payment options

The future of mobile payments suggests a move towards a more seamless and integrated ecosystem. We can anticipate a significant rise in the adoption of tokenization, where sensitive payment information is replaced with unique digital tokens, enhancing security. Furthermore, the convergence of mobile payments with other technologies, such as the Internet of Things (IoT), will lead to new payment scenarios, like automated payments for smart home devices or connected cars. The increasing popularity of buy-now-pay-later (BNPL) services integrated into mobile wallets suggests a shift in consumer behavior towards flexible payment options. We’ll likely see a greater focus on personalized payment experiences, tailored to individual spending habits and preferences. Finally, the regulatory landscape will continue to evolve, shaping the future of mobile payments by balancing innovation with consumer protection. For example, the growing focus on data privacy regulations like GDPR will continue to influence the design and implementation of mobile payment systems.

Opportunities and Challenges for Mobile Payment Providers

The future presents significant opportunities for mobile payment providers. Expanding into new markets, particularly in developing countries with high mobile penetration but limited traditional banking infrastructure, offers substantial growth potential. Developing innovative payment solutions tailored to specific industry needs, such as integrated payment solutions for e-commerce platforms or loyalty programs, will also be crucial. Strategic partnerships with other technology companies and financial institutions can create synergistic opportunities, allowing providers to leverage existing customer bases and expand their service offerings. However, challenges remain. Maintaining robust security against increasingly sophisticated cyber threats is paramount. Adapting to evolving consumer preferences and regulatory changes requires continuous innovation and investment. Competition from established players and new entrants will necessitate a focus on differentiation and value-added services. Finally, ensuring financial inclusion and accessibility for all demographics remains a significant challenge.

Projected Growth of Mobile Payment Usage

The following is a description of a bar graph illustrating the projected growth of mobile payment usage over the next five years. The horizontal axis represents the year, starting from the current year and extending five years into the future. The vertical axis represents the percentage of total transactions conducted via mobile payments. The graph would show a steady upward trend, with each subsequent year displaying a higher percentage than the previous one. For instance, if the current year shows 40% mobile payment usage, the following year might show 45%, then 50%, 55%, and finally 60% in five years’ time. This would represent a significant increase in adoption, mirroring the predicted growth seen in markets like China and South Korea, where mobile payment penetration is already extremely high. The graph could include data points to represent actual projected percentages, adding further clarity. The overall visual would clearly communicate the anticipated exponential growth in mobile payment usage, emphasizing the significant shift in consumer behavior and the increasing dominance of mobile payments in the global financial landscape. The data points would ideally be based on reputable market research and industry analysis to ensure credibility.

Mobile payment options are rapidly evolving, offering consumers increased convenience and businesses new avenues for growth. Understanding how these options contribute to a broader ecosystem requires considering a company’s Shared value creation strategy , as the design and implementation of mobile payment systems directly impact both user experience and business profitability. Ultimately, successful mobile payment solutions are built upon a foundation of shared value, benefiting both the provider and the customer.

Impact on Traditional Payment Methods

The rise of mobile payments has significantly altered the landscape of financial transactions, posing both challenges and opportunities for traditional payment methods like credit cards and cash. This shift is reshaping consumer behavior and forcing established players in the financial industry to adapt to a rapidly evolving technological environment. Understanding this impact is crucial for businesses and policymakers alike.

The increasing popularity of mobile payment systems presents a direct challenge to the dominance of traditional methods. Mobile payments offer convenience, speed, and integration with other digital services, attracting a growing segment of consumers, particularly younger generations. This shift is not simply a matter of preference; it’s fundamentally changing how transactions are processed, tracked, and secured.

Comparison of Mobile Payments and Traditional Methods

Mobile payments and traditional methods like credit cards and cash offer distinct advantages and disadvantages. A direct comparison reveals a clear contrast in functionality, security features, and overall user experience.

- Convenience: Mobile payments often provide a more streamlined and convenient transaction process, eliminating the need for physical cards or cash. Credit cards, while widely accepted, require carrying a physical card and may involve additional steps like signing receipts. Cash transactions, though simple, present issues of security and tracking.

- Security: Mobile payment systems often incorporate robust security features like biometric authentication and tokenization, mitigating the risks of fraud and theft associated with physical cards and cash. However, mobile payments are vulnerable to hacking and phishing scams if security protocols are not properly implemented. Credit cards offer some protection through fraud liability policies, but physical loss or theft remains a concern. Cash, being easily lost or stolen, presents the highest security risk.

- Cost: The cost of mobile payments can vary depending on the platform and transaction fees. Credit card transactions typically involve merchant fees, while cash transactions are generally free of processing charges.

- Acceptance: While mobile payment adoption is growing rapidly, the acceptance rate still lags behind credit cards and cash in many regions and for certain types of merchants. Cash remains universally accepted, although its use is declining in many developed countries.

Impact on the Financial Industry

The widespread adoption of mobile payments is significantly impacting the financial industry. Traditional payment processors and banks are adapting their strategies to remain competitive. The shift towards mobile payments has led to increased competition, driving innovation in payment technology and services. Financial institutions are investing heavily in developing their own mobile payment platforms and integrating with existing mobile ecosystems. For example, many banks now offer their own mobile apps for payments and money transfers, competing directly with standalone mobile payment providers. This competition is forcing banks to improve efficiency and reduce costs to stay relevant in the evolving market. Furthermore, the increased volume of digital transactions has spurred the development of new financial products and services, such as personalized budgeting tools and financial analytics integrated directly into mobile banking apps.

Conclusion: Mobile Payment Options

The world of mobile payments is dynamic and innovative, driven by technological advancements and shifting consumer preferences. While security concerns remain paramount, the industry’s continuous adaptation and implementation of robust security measures promise a future where mobile transactions are seamless, secure, and ubiquitous. The convenience and efficiency offered by mobile payment options are undeniable, signifying a significant shift in the global financial landscape.

Mobile payment options are rapidly evolving, impacting how businesses price their goods and services. Understanding the nuances of consumer behavior in this digital landscape requires a thorough Pricing strategy analysis , which can then inform decisions on transaction fees, incentives, and overall mobile payment integration. Ultimately, a well-defined pricing strategy is key to maximizing the potential of mobile payment options for both businesses and customers.