Investing in Emerging Markets presents a compelling opportunity for significant returns, but also carries substantial risks. This exploration delves into the multifaceted landscape of emerging market investments, examining the diverse opportunities and inherent challenges. We will navigate the complexities of defining emerging markets, exploring promising investment sectors and the crucial role of risk mitigation strategies. The journey will also encompass the growing significance of ESG factors and conclude with insightful case studies that illuminate both triumphs and pitfalls in this dynamic investment arena.

Understanding the nuances of emerging market economies is crucial for informed decision-making. From analyzing macroeconomic indicators and navigating currency fluctuations to employing effective risk management techniques, we aim to equip investors with the knowledge necessary to make well-considered choices. We will cover various investment approaches, including direct investment, mutual funds, and ETFs, and discuss the merits of active versus passive investment strategies.

Defining Emerging Markets

Emerging markets represent a significant and dynamic segment of the global economy, offering investors both substantial opportunities and considerable risks. Understanding their unique characteristics is crucial for navigating this complex landscape. These markets are characterized by rapid economic growth, often coupled with significant structural changes and volatility.

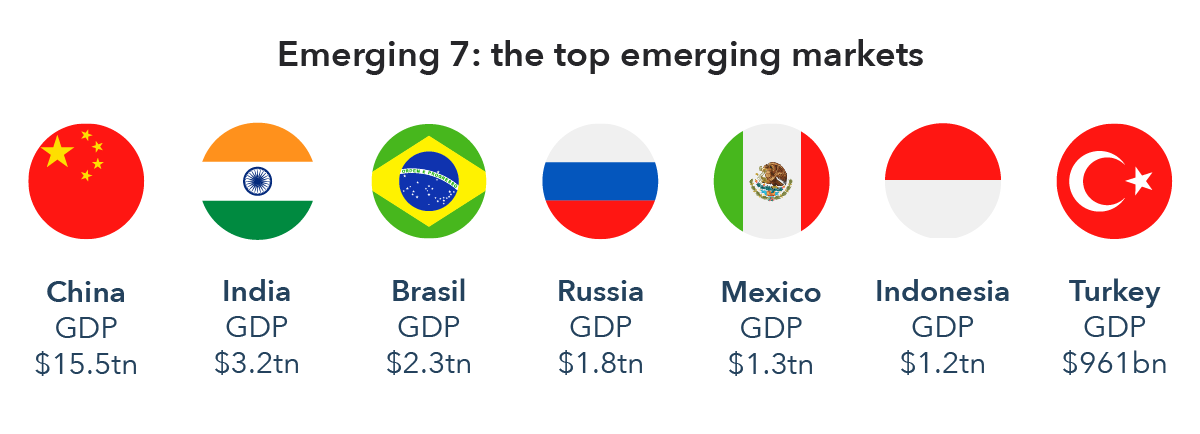

Defining emerging markets involves considering a range of economic, political, and social factors. There is no single universally accepted definition, but several organizations, including the MSCI and FTSE, use various criteria to classify countries. These criteria often include factors such as GDP per capita, economic growth rates, market capitalization, and the level of financial development. The process is constantly evolving, reflecting the dynamic nature of these economies.

Criteria for Classifying Emerging Markets

Several key indicators contribute to a country’s classification as an emerging market. These indicators assess a nation’s economic maturity and integration into the global financial system. High GDP growth rates, while not always a guarantee of sustained development, are a common feature. Furthermore, the size and liquidity of a country’s stock market, alongside its overall financial infrastructure, play a significant role. Political stability and the strength of institutions are also important factors, as they influence investor confidence and long-term economic prospects. Countries with robust legal frameworks and transparent governance tend to attract more foreign investment.

Comparison of Emerging Market Regions

Emerging markets are geographically diverse, each region exhibiting distinct characteristics influencing investment decisions. Asia, for example, boasts a large and rapidly growing middle class, driving consumer demand. Latin America, on the other hand, often experiences higher levels of income inequality and political instability. Africa presents a complex picture, with significant variations in economic development across its diverse nations. Some African countries are experiencing rapid growth, while others continue to grapple with poverty and conflict.

Regional Characteristics, Opportunities, and Risks

| Region | Key Characteristics | Investment Opportunities | Risks |

|---|---|---|---|

| Asia (e.g., China, India) | Rapid economic growth, large and growing middle class, technological innovation, increasing urbanization | Infrastructure development, consumer goods, technology, manufacturing | Geopolitical risks, regulatory uncertainty, currency volatility, environmental concerns |

| Latin America (e.g., Brazil, Mexico) | Abundant natural resources, growing consumer markets, increasing regional integration | Commodities, infrastructure, consumer goods, renewable energy | Political instability, high inflation, corruption, income inequality |

| Africa (e.g., Nigeria, Kenya) | High population growth, abundant natural resources, growing mobile phone penetration | Infrastructure development, agriculture, technology, telecommunications | Political instability, weak infrastructure, corruption, disease |

Investment Opportunities in Emerging Markets: Investing In Emerging Markets

Investing in emerging markets presents a unique blend of high potential returns and significant risks. These markets, characterized by rapid economic growth and evolving infrastructure, offer diverse investment opportunities across various sectors. However, understanding the specific dynamics of each sector and the broader macroeconomic environment is crucial for successful investment strategies.

Promising Sectors for Investment

Three particularly promising sectors for investment in emerging markets are technology, infrastructure, and consumer goods. The technology sector benefits from a burgeoning young population increasingly adopting digital technologies. Infrastructure development is essential for supporting economic growth and urbanization. Finally, the consumer goods sector thrives on rising disposable incomes and changing consumption patterns.

Technology Sector Investment

The technology sector in emerging markets is experiencing explosive growth driven by increasing smartphone penetration, expanding internet access, and a young, tech-savvy population. This presents opportunities in e-commerce, fintech, and software development. Potential returns can be substantial, particularly for early-stage investments in innovative companies. However, risks include regulatory uncertainty, intellectual property protection challenges, and potential volatility due to market fluctuations. For example, the rapid growth of mobile money services in Africa showcases the potential for high returns, but also highlights the regulatory complexities involved.

Infrastructure Sector Investment

Investment in infrastructure, including transportation, energy, and utilities, is crucial for supporting economic growth in emerging markets. Governments in many emerging economies are actively pursuing large-scale infrastructure projects, creating significant investment opportunities. Potential returns can be substantial, particularly in long-term projects with stable cash flows. However, risks include project delays, cost overruns, and political instability. The construction of new high-speed rail networks in several Asian countries illustrates both the potential for substantial returns and the challenges associated with complex, large-scale projects.

Consumer Goods Sector Investment

The consumer goods sector benefits from rising disposable incomes and a growing middle class in many emerging markets. Opportunities exist across various sub-sectors, including food and beverage, personal care, and apparel. Potential returns can be significant, particularly for companies targeting the rapidly expanding middle class. However, risks include competition from established international brands, fluctuations in commodity prices, and changing consumer preferences. The success of several multinational consumer goods companies in adapting their products to the specific needs and preferences of emerging markets demonstrates the potential for profitability but also the need for thorough market research and localization strategies.

Impact of Macroeconomic Factors

Macroeconomic factors significantly influence investment opportunities in emerging markets. High inflation can erode returns, while fluctuating interest rates affect borrowing costs and investment valuations. Currency fluctuations can impact the profitability of investments denominated in foreign currencies. For example, a sudden devaluation of the local currency can significantly reduce the returns for foreign investors. Careful consideration of these factors is essential for effective risk management.

Due Diligence Process for Emerging Market Investments

A robust due diligence process is crucial for mitigating risks and identifying promising investment opportunities in emerging markets. This process should include:

- Thorough market research and analysis, including assessment of market size, growth potential, and competitive landscape.

- Detailed financial analysis of potential investment targets, including review of financial statements, cash flow projections, and valuation.

- Assessment of political and regulatory risks, including analysis of political stability, regulatory frameworks, and potential policy changes.

- Evaluation of operational risks, including assessment of management capabilities, operational efficiency, and supply chain resilience.

- Currency risk assessment and hedging strategies to mitigate potential losses from currency fluctuations.

- Environmental, social, and governance (ESG) considerations, including assessment of the environmental and social impact of potential investments.

Risks and Challenges of Investing in Emerging Markets

Investing in emerging markets offers significant potential for high returns, but it also comes with a unique set of risks and challenges that investors must carefully consider. These risks are often interconnected and can amplify each other, leading to substantial losses if not properly managed. A thorough understanding of these risks is crucial for informed decision-making and successful investment strategies.

Political and Economic Risks

Emerging markets are often characterized by political instability, weak institutions, and volatile economic conditions. Examples of significant political risks include sudden changes in government, corruption, social unrest, and conflicts. Economic risks can manifest as high inflation, currency devaluation, balance of payments crises, and sovereign debt defaults. For instance, the Argentinian economy has experienced periods of hyperinflation and default on its sovereign debt, significantly impacting investor returns. Similarly, political instability in certain African nations has led to project delays and asset losses for foreign investors. These risks are often interconnected; political instability can easily trigger economic turmoil, and vice-versa.

Currency Risk, Investing in Emerging Markets

Currency risk, also known as exchange rate risk, arises from fluctuations in the value of an emerging market’s currency relative to the investor’s home currency. A weakening local currency can significantly reduce the value of an investment when converted back to the home currency. For example, an investor who invests in a Brazilian company and the Brazilian Real depreciates against the US dollar will see a lower return in dollar terms, even if the Brazilian company performs well. Mitigation strategies include hedging using currency forwards or options contracts, diversifying investments across multiple currencies, and investing in companies that generate a significant portion of their revenue in hard currencies. Careful analysis of currency trends and macroeconomic factors is crucial in managing this risk.

Regulatory Changes and Geopolitical Events

Changes in government regulations and geopolitical events can significantly impact investments in emerging markets. Unexpected regulatory changes, such as increased taxation or stricter environmental regulations, can negatively affect profitability and investment value. Geopolitical events, such as trade wars, sanctions, or regional conflicts, can create uncertainty and volatility, leading to capital flight and market crashes. The imposition of sanctions on Russia following its invasion of Ukraine significantly impacted investments in Russian assets and global commodity markets. Investors need to carefully monitor political developments and regulatory changes to assess potential risks and adjust their investment strategies accordingly.

Risk Mitigation Strategies

A range of strategies can be employed to mitigate the risks associated with emerging market investments. The effectiveness of each strategy depends on the specific investment, market conditions, and investor’s risk tolerance.

| Strategy | Description | Advantages | Disadvantages |

|---|---|---|---|

| Diversification | Spreading investments across multiple countries, sectors, and asset classes within emerging markets. | Reduces exposure to country-specific or sector-specific risks. | Requires more research and monitoring; may not fully eliminate all risks. |

| Hedging | Using financial instruments, such as currency forwards or options, to protect against currency fluctuations or other risks. | Provides a degree of protection against specific risks. | Can be expensive; may not be effective against all types of risks. |

| Local Expertise | Partnering with local managers or advisors who have in-depth knowledge of the market. | Provides valuable insights into local market dynamics and risks. | Can be costly; requires careful due diligence to ensure expertise and integrity. |

| Fundamental Analysis | Thorough research of companies’ financial performance, management quality, and competitive landscape. | Helps identify undervalued companies with strong growth potential. | Time-consuming; requires specialized skills and knowledge. |

Investment Strategies for Emerging Markets

Investing in emerging markets presents a unique set of opportunities and challenges. Successful participation requires a well-defined strategy tailored to your risk tolerance and investment goals. This section explores various approaches, offering insights into building a diversified portfolio and leveraging different analytical techniques.

Approaches to Emerging Market Investing

Several avenues exist for gaining exposure to emerging markets. Each offers a distinct balance of control, diversification, and cost. Direct investment involves purchasing shares of individual companies listed on emerging market exchanges. This provides maximum control but demands extensive research and carries higher risk due to potential illiquidity and volatility. Mutual funds offer diversified exposure through a professionally managed portfolio of emerging market securities. They simplify investment but involve management fees and may not always perfectly align with individual investor goals. Exchange-Traded Funds (ETFs) offer similar diversification to mutual funds but trade like stocks, providing greater flexibility and often lower expense ratios. However, ETFs can still be subject to market fluctuations.

Building a Diversified Emerging Market Portfolio

Constructing a well-diversified portfolio is crucial to mitigate risk. A step-by-step approach is recommended:

- Define Investment Goals and Risk Tolerance: Clearly articulate your investment objectives (e.g., capital appreciation, income generation) and your comfort level with risk. This will guide your asset allocation.

- Determine Asset Allocation: Allocate your investment capital across different asset classes (e.g., equities, bonds, real estate) and geographical regions within emerging markets. Consider diversifying across various sectors and company sizes.

- Select Investment Vehicles: Based on your risk tolerance and goals, choose appropriate investment vehicles such as individual stocks, mutual funds, or ETFs. A mix is often ideal.

- Implement and Monitor: Regularly review and rebalance your portfolio to maintain your desired asset allocation and adjust to changing market conditions. This requires ongoing monitoring of market trends and your investment performance.

For example, a moderately risk-tolerant investor might allocate 60% to emerging market equities (split between a diversified ETF and a few selectively chosen individual stocks), 30% to emerging market bonds, and 10% to developed market assets for diversification and stability.

Active versus Passive Investment Strategies

Active management involves actively selecting individual securities based on market analysis and predictions. This approach aims to outperform market benchmarks but requires significant research and expertise, and does not always guarantee success. Passive management, on the other hand, involves tracking a market index, such as an emerging market ETF, minimizing management fees and effort. While less likely to outperform the market significantly, it offers consistent returns reflecting overall market performance. The choice depends on individual resources, expertise, and risk appetite. For example, a novice investor might prefer a passive strategy using ETFs, while a seasoned investor with deep market knowledge might pursue active management.

Fundamental and Technical Analysis in Emerging Market Selection

Fundamental analysis focuses on evaluating the intrinsic value of a company or asset based on its financial statements, economic conditions, and industry trends. This involves examining factors like earnings, revenue growth, debt levels, and competitive landscape. Technical analysis, conversely, uses historical price and volume data to identify patterns and predict future price movements. It involves studying charts, indicators, and trends. A combination of both approaches is often beneficial for making informed investment decisions. For instance, fundamental analysis might reveal a company’s strong growth potential, while technical analysis could indicate a favorable entry point based on chart patterns. However, it’s crucial to remember that neither approach guarantees success, and both require significant skill and experience.

Case Studies of Successful and Unsuccessful Investments

Investing in emerging markets presents a unique blend of high potential returns and significant risks. Analyzing both successful and unsuccessful investment cases provides invaluable insights into the factors driving profitability and the pitfalls to avoid. Understanding these contrasting experiences allows investors to refine their strategies and improve their chances of success.

Successful Investment: Tencent Holdings in China

Tencent’s rise exemplifies a successful investment in an emerging market. The company’s early focus on internet services, particularly messaging and gaming, tapped into the rapidly expanding Chinese digital landscape. Strategic partnerships, aggressive expansion, and adaptation to evolving consumer preferences fueled Tencent’s growth. Early investors who recognized the potential of the Chinese market and Tencent’s innovative approach were handsomely rewarded. The company’s diversification into fintech and other sectors further solidified its position as a dominant player in the global technology scene, highlighting the benefits of long-term investment in a dynamic market. This success is attributable to a combination of strong management, a clear understanding of the local market, and a capacity to adapt to changing circumstances.

Unsuccessful Investment: Investments in the Venezuelan Oil Sector (Post-2000s)

In contrast, many investments in Venezuela’s oil sector since the early 2000s illustrate the perils of emerging market investing. Political instability, nationalization policies, and economic mismanagement created a volatile and unpredictable environment. Investors faced significant challenges, including expropriation risks, currency devaluation, and difficulties in repatriating profits. The lack of transparency, coupled with high levels of corruption, eroded investor confidence. While the oil sector initially held immense promise, the underlying political and economic risks ultimately led to substantial losses for many foreign investors. This case highlights the critical importance of thorough due diligence, including a robust assessment of political and economic risks, before committing capital to an emerging market.

Comparative Analysis of Case Studies

| Factor | Tencent Holdings (Successful) | Venezuelan Oil Sector (Unsuccessful) |

|---|---|---|

| Political and Economic Stability | Initially stable, with growing economic opportunities | High political risk, economic instability, and nationalization policies |

| Regulatory Environment | Initially favorable, though evolving | Unpredictable and often hostile regulatory environment |

| Company Management and Strategy | Strong management, innovative strategy, adaptation to market changes | Management challenges, lack of transparency, and susceptibility to political influence |

| Risk Assessment and Mitigation | Thorough market research, diversification of investments | Inadequate risk assessment, insufficient mitigation strategies |

| Investment Outcome | High returns, significant capital appreciation | Significant losses, expropriation, difficulty repatriating profits |

Lessons Learned

The contrasting outcomes of these case studies highlight several crucial lessons. Successful emerging market investments require a comprehensive understanding of the local political and economic landscape, a robust risk assessment framework, and a long-term investment horizon. Careful due diligence, including a thorough evaluation of regulatory risks and potential political instability, is paramount. Furthermore, selecting companies with strong management teams, innovative business models, and a proven ability to adapt to changing market conditions is essential for maximizing the chances of success. Conversely, neglecting these factors can lead to substantial losses, as demonstrated by the Venezuelan oil sector example. Diversification across different sectors and geographies within an emerging market can also help mitigate risks.

The Role of ESG Factors in Emerging Market Investing

The integration of Environmental, Social, and Governance (ESG) factors into investment decisions is no longer a niche strategy; it’s rapidly becoming a mainstream approach, particularly within emerging markets. Investors are increasingly recognizing that ESG performance is intrinsically linked to long-term value creation and risk mitigation, offering both opportunities and challenges unique to these dynamic economies.

ESG factors represent a crucial lens through which to assess the sustainability and resilience of businesses operating in emerging markets. These markets often grapple with significant environmental challenges, social inequalities, and governance weaknesses, creating both substantial risks and compelling opportunities for investors who proactively incorporate ESG considerations into their investment processes.

ESG Risks and Opportunities in Emerging Markets

Emerging markets present a complex interplay of ESG risks and opportunities. Environmental risks include deforestation, pollution, and climate change vulnerability. Social risks encompass issues like labor exploitation, inequality, and lack of access to essential services. Governance risks involve corruption, weak regulatory frameworks, and lack of transparency. However, these same challenges also present opportunities for investment in sustainable solutions, such as renewable energy, responsible agriculture, and improved infrastructure. For example, the growing demand for cleaner energy in rapidly developing nations presents significant investment opportunities in solar, wind, and other renewable energy technologies. Similarly, the need for improved infrastructure creates opportunities for investment in sustainable transportation, water management, and waste management systems.

ESG Considerations and Investment Strategy

ESG considerations significantly influence investment strategy and portfolio construction in several ways. First, a robust ESG integration process involves screening potential investments to identify companies with strong ESG profiles and those that pose significant ESG risks. This screening process can range from negative screening (excluding companies with poor ESG performance) to positive screening (selecting companies with strong ESG performance). Second, ESG integration can lead to active ownership, where investors engage with companies to improve their ESG performance. This engagement can involve dialogue with management, shareholder resolutions, and collaborative initiatives with other investors. Third, ESG integration can inform investment decisions in specific sectors, such as renewable energy or sustainable agriculture, where the potential for both financial returns and positive social and environmental impact is high. For example, an investor might prioritize companies committed to reducing carbon emissions or improving worker safety, even if this means accepting slightly lower short-term returns.

Visual Representation of ESG and Investment Returns

Imagine a three-dimensional graph. The X-axis represents the level of ESG integration in an investment strategy (ranging from low to high). The Y-axis represents the level of risk associated with investments in emerging markets (ranging from high to low). The Z-axis represents the potential return on investment (ranging from low to high). The graph would show a general upward trend in the Z-axis as the X-axis (ESG integration) increases, particularly at higher levels of risk (higher Y-axis values). This illustrates that higher levels of ESG integration tend to be associated with higher returns, especially when navigating the inherent risks of emerging markets. However, the graph would also show that at very low levels of ESG integration, even at lower risk levels, returns could be negatively impacted by ESG-related incidents or controversies. The relationship isn’t strictly linear; there will be variations depending on the specific market, sector, and company, but the overall trend demonstrates the positive correlation between robust ESG integration and long-term investment success in emerging markets. This is because companies with strong ESG profiles tend to be more resilient to risks, better positioned for long-term growth, and more attractive to investors concerned about sustainability and responsible investing.

Investing in emerging markets demands a careful balance between seizing high-growth potential and mitigating significant risks. This exploration has highlighted the importance of thorough due diligence, diversification, and a comprehensive understanding of the political, economic, and social landscapes of target regions. By incorporating ESG considerations and leveraging diverse investment strategies, investors can strive to maximize returns while minimizing potential downsides. Ultimately, success hinges on a well-informed approach, a robust risk management plan, and a long-term perspective.

Investing in emerging markets presents significant opportunities, but navigating their complexities requires a strategic approach. Successfully expanding into these markets often hinges on building strong local relationships, and this is where leveraging Strategic Partnerships to Expand Reach becomes crucial. These partnerships provide invaluable insights and access, ultimately increasing the likelihood of a successful investment in emerging markets.

Investing in emerging markets presents unique opportunities, but success hinges on understanding local needs. A key element is adopting effective customer-centric business strategies, as detailed in this insightful guide: Customer-Centric Business Strategies. By prioritizing customer preferences and tailoring offerings accordingly, investors can significantly improve their chances of navigating the complexities and realizing strong returns in these dynamic markets.