Exploring Emerging Market Opportunities presents a compelling landscape of growth and potential. These dynamic markets, characterized by rapid economic expansion and evolving consumer behaviors, offer significant returns for businesses willing to navigate their unique challenges. This analysis delves into the key aspects of successfully entering and operating within these environments, from identifying promising markets and developing effective entry strategies to managing inherent risks and leveraging technological advancements for sustainable growth.

We will examine diverse market entry strategies, analyze consumer behavior patterns, and explore the crucial role of technology and innovation in shaping these markets’ future. Furthermore, we will consider the importance of incorporating sustainable practices and achieving positive social impact alongside profitability. This comprehensive approach aims to equip businesses with the knowledge and tools necessary to thrive in the exciting, yet complex, world of emerging markets.

Identifying Promising Emerging Markets Exploring Opportunities

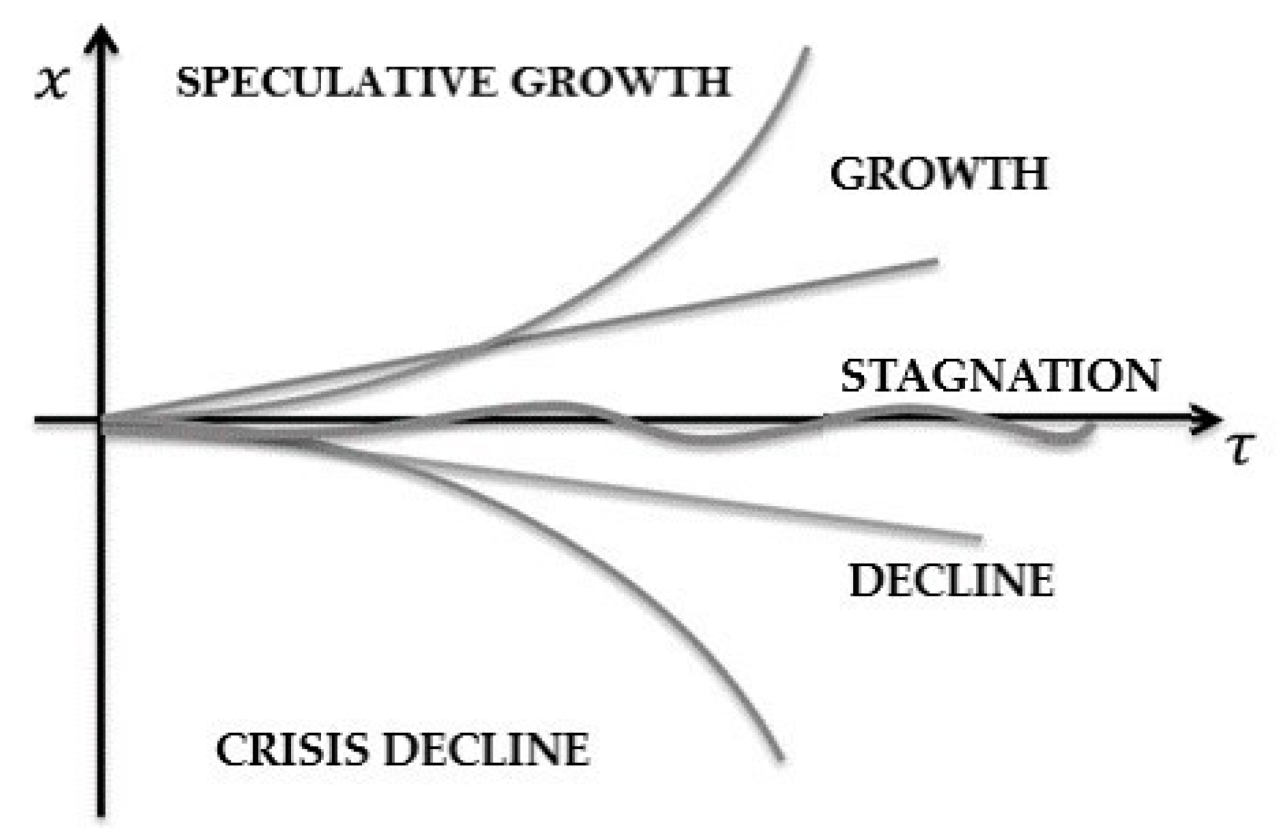

Pinpointing emerging markets poised for significant growth requires a nuanced understanding of economic indicators, regulatory landscapes, and demographic shifts. While predicting the future is inherently uncertain, analyzing current trends allows for informed speculation about promising investment destinations. This section will explore three such markets, highlighting their strengths and potential challenges.

Three High-Growth Emerging Markets Exploring Opportunities

Several emerging markets exhibit compelling growth potential over the next decade. Factors such as robust GDP growth, young and expanding populations, and strategic geopolitical positioning contribute to their attractiveness. We will focus on India, Indonesia, and Vietnam as examples.

India’s sustained economic growth, fueled by a burgeoning middle class and a young, tech-savvy population, positions it as a key player. Its GDP growth consistently ranks among the highest globally, indicating a robust and expanding economy. Indonesia, the largest economy in Southeast Asia, benefits from its abundant natural resources and strategic location. Its relatively young population and growing consumer market present substantial opportunities. Vietnam’s consistent economic reforms, coupled with its strategic geographic location and access to global markets, have propelled its rapid economic advancement, attracting significant foreign investment.

Exploring emerging market opportunities requires a strategic approach. Successfully penetrating these markets often necessitates a significant expansion of your operational capabilities, which is where understanding how to effectively Scaling Your Business Operations becomes crucial. Efficient scaling allows you to manage increased demand and maintain quality while capitalizing on the growth potential these new markets offer, ultimately enhancing your overall success in exploring emerging market opportunities.

Regulatory Environment Comparison: India and Vietnam

India and Vietnam, while both exhibiting strong growth potential, present contrasting regulatory environments. India, a large and complex market, has a multi-layered regulatory system that can be challenging to navigate for foreign businesses. Navigating bureaucratic processes and complying with diverse regulations across states can present significant hurdles. However, recent reforms aimed at streamlining business regulations and improving ease of doing business are slowly improving the situation. Vietnam, on the other hand, is known for its relatively simpler and more streamlined regulatory framework, making it attractive for foreign investors seeking a less complex entry point into the Southeast Asian market. However, the rapid pace of regulatory changes in Vietnam can sometimes create uncertainty for businesses. While Vietnam offers a less bureaucratic environment, the potential for abrupt shifts in regulations needs careful consideration.

Demographic Trends in Indonesia: Implications for Businesses

Indonesia boasts a significant and young population, with a large proportion falling within the working-age bracket. This demographic dividend presents immense opportunities for businesses across various sectors. The expanding middle class is driving increased demand for consumer goods and services, creating a large and growing market for everything from food and beverages to technology and healthcare. However, businesses must also adapt to the diverse cultural landscape and regional variations within Indonesia to effectively target this expanding market. This requires localized marketing strategies and product adaptations to resonate with specific consumer segments. The increasing urbanization also presents both opportunities and challenges. While it concentrates consumer demand in urban centers, it also necessitates infrastructure development and solutions to address urban challenges.

Assessing Market Entry Strategies

Selecting the right market entry strategy is crucial for a technology company aiming to succeed in a dynamic emerging market. The choice depends on factors like the company’s resources, the market’s regulatory environment, the level of competition, and the specific characteristics of the target consumer base. A well-defined strategy minimizes risk and maximizes the potential for growth and profitability.

Three Exploring Emerging Market Opportunities Entry Strategies for a Technology Company

Three distinct market entry strategies can be employed by a hypothetical technology company, each with its own advantages and disadvantages. These strategies cater to different levels of commitment and risk tolerance.

- Exporting: This involves selling products manufactured in the home country directly to customers or distributors in the emerging market. This is a low-risk, low-investment approach suitable for companies with limited resources or those testing the market’s viability before a larger commitment. However, exporting can be hampered by high transportation costs, tariffs, and potential logistical challenges.

- Licensing/Franchising: This strategy involves granting a local company the right to manufacture and sell the technology company’s products or services in the emerging market in exchange for royalties. This requires less capital investment than direct ownership but may limit control over quality, marketing, and brand image. It is a good option for companies wanting to quickly expand into a new market with minimal risk.

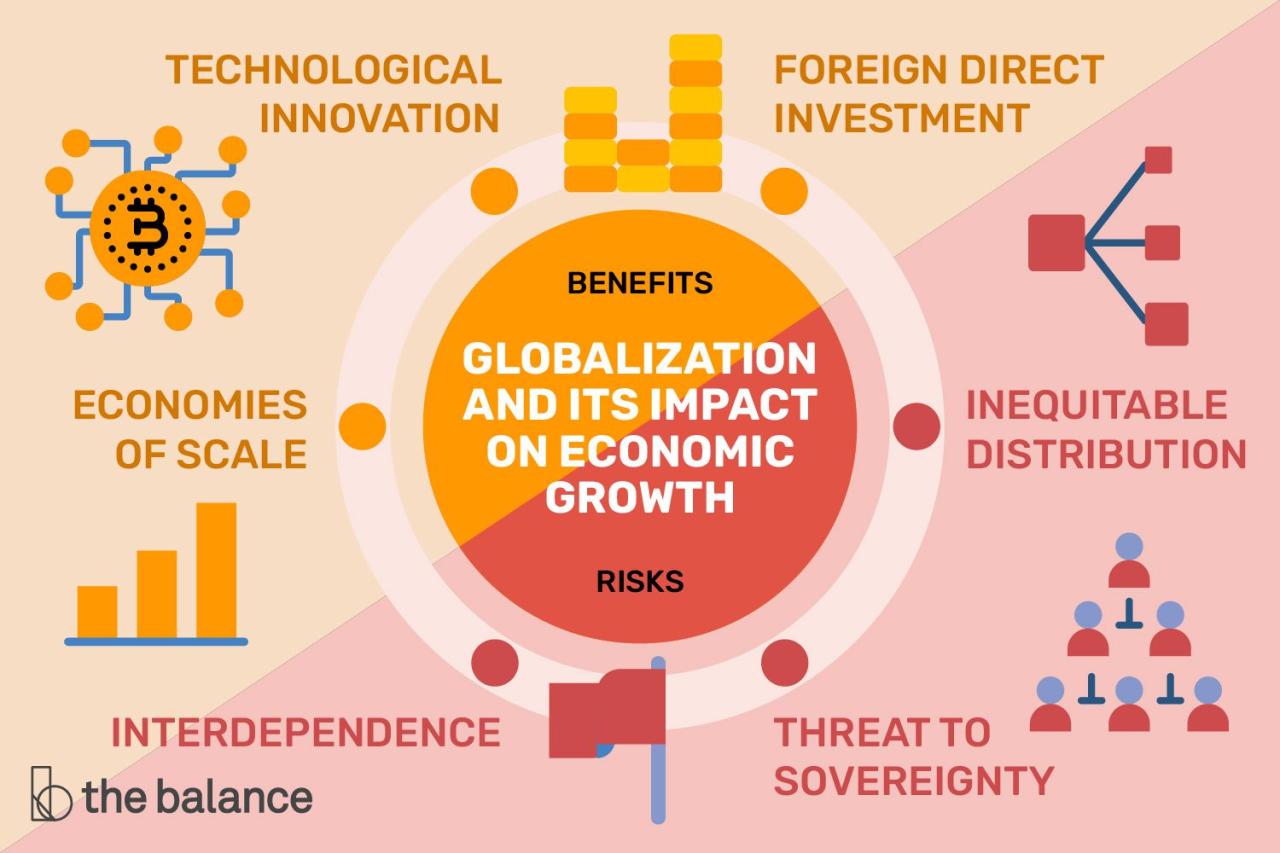

- Foreign Direct Investment (FDI): This involves establishing a wholly-owned subsidiary or engaging in a joint venture within the emerging market. This offers the greatest control and potential for long-term growth, but it also carries the highest level of risk and investment. It allows for greater adaptation to local needs and market dynamics.

Joint Ventures versus Wholly-Owned Subsidiaries

The decision between a joint venture and a wholly-owned subsidiary hinges on several critical factors. A joint venture involves partnering with a local company, sharing resources, expertise, and risk. A wholly-owned subsidiary, on the other hand, provides complete control but requires significantly more investment and assumes all the risk.

| Feature | Joint Venture | Wholly-Owned Subsidiary |

|---|---|---|

| Control | Shared | Complete |

| Investment | Lower | Higher |

| Risk | Shared | Solely on the company |

| Market Knowledge | Access to local expertise | Requires independent market research |

| Regulatory Compliance | Easier navigation with local partner | Requires independent compliance efforts |

In an emerging market context, joint ventures often provide access to crucial local knowledge, networks, and regulatory expertise, mitigating some risks. However, shared control can lead to slower decision-making and potential conflicts of interest. A wholly-owned subsidiary allows for greater strategic autonomy but necessitates a deeper understanding of the local market and regulatory landscape, and involves higher initial investment. The optimal choice depends on the specific circumstances and the company’s risk appetite.

Cultural Understanding in Market Entry Strategy Development

Cultural understanding is paramount for developing a successful market entry strategy in any emerging market. Ignoring cultural nuances can lead to marketing mishaps, communication breakdowns, and ultimately, market failure. For example, a technology company targeting the Indian market needs to understand the diverse linguistic and regional variations, the importance of family and community ties, and the preference for certain communication styles. Similarly, understanding the importance of guanxi (relationships) in China is crucial for building trust and navigating business relationships. Adapting marketing messages, product features, and distribution channels to align with local cultural norms is essential for achieving market penetration and building a strong brand presence. Failure to do so can lead to wasted resources and lost opportunities. A successful strategy requires thorough market research, cultural sensitivity training for employees, and a willingness to adapt to local customs and preferences.

Understanding Consumer Behavior in Emerging Markets

Understanding consumer behavior in emerging markets is crucial for successful business ventures. These markets are characterized by diverse demographics, rapidly evolving economic conditions, and unique cultural nuances that significantly influence purchasing decisions. Analyzing these factors allows businesses to tailor their strategies for optimal market penetration and sustainable growth.

Consumer Behavior in India: Purchasing Power and Brand Loyalty

India presents a compelling case study in emerging market consumer behavior. Its vast population, coupled with a burgeoning middle class, represents a significant market opportunity. However, purchasing power varies drastically across different socioeconomic strata. While a significant portion of the population possesses limited disposable income, a growing segment enjoys increased purchasing power, leading to a diverse range of consumer needs and preferences. Brand loyalty, while present, is often less entrenched than in developed markets. Consumers are more price-sensitive and readily switch brands based on promotions, perceived value, and availability. This necessitates flexible marketing strategies that cater to both price-conscious and brand-conscious segments.

Examples of Successful and Unsuccessful Marketing Campaigns in India

A successful example is Hindustan Unilever’s strategy of offering smaller, more affordable pack sizes of their products. This effectively targets lower-income consumers who might otherwise be unable to afford larger quantities. Conversely, a campaign that failed to consider cultural sensitivities or purchasing power dynamics would likely struggle to gain traction. For example, a luxury brand launching a high-priced product with limited local appeal would likely experience low sales, demonstrating the importance of market research and culturally sensitive marketing strategies. Successful campaigns often leverage digital platforms, given the high mobile penetration rates in the country.

Characteristics of the Indian Middle Class

The Indian middle class is a diverse group, and understanding its characteristics is key to effective targeting. The following table summarizes key aspects:

| Demographics | Income Levels (USD per annum) | Spending Habits | Brand Preferences |

|---|---|---|---|

| Varied age groups, predominantly urban, increasing education levels, growing nuclear families | $5,000 – $50,000 (a broad range reflecting significant internal variations) | Increased spending on durables, healthcare, education, and experiences; price sensitivity remains a key factor; growing preference for online shopping | Mix of both international and domestic brands; preference for value for money and quality; increasing awareness of ethical and sustainable brands |

Managing Risks in Emerging Markets

Investing in emerging markets presents significant opportunities for growth, but also carries substantial risks. Understanding and mitigating these risks is crucial for successful market entry and sustained profitability. This section will explore key political and economic risks, outlining a risk mitigation strategy and providing a framework for managing various risk categories.

Major Political and Economic Risks in Emerging Markets

Three major political and economic risks commonly associated with emerging markets are political instability, currency fluctuations, and regulatory uncertainty. Political instability, encompassing events like coups, civil unrest, and changes in government policy, can significantly disrupt business operations and investment returns. Currency fluctuations, driven by macroeconomic factors and market sentiment, create volatility in revenue streams and can impact profitability. Regulatory uncertainty, stemming from evolving laws and inconsistent enforcement, poses challenges for businesses trying to navigate the legal landscape and comply with local regulations. These risks are interconnected; for instance, political instability often leads to currency devaluation and increased regulatory unpredictability.

Risk Mitigation Strategy: Addressing Political Instability and Currency Fluctuations

For a company entering, for example, the Vietnamese market, a robust risk mitigation strategy is paramount. To address potential political instability, a diversified approach is necessary. This includes thorough due diligence on the political climate, engaging with local experts and stakeholders to understand potential risks and build relationships, and developing contingency plans to adapt to sudden political shifts. For instance, having multiple supply chain options or establishing regional operational hubs can help mitigate disruptions caused by political instability. To mitigate currency fluctuations, hedging strategies, such as using forward contracts or options, can help lock in exchange rates and protect against losses. Furthermore, diversifying revenue streams in different currencies can reduce the overall impact of currency volatility. Establishing local partnerships and understanding the nuances of Vietnamese business culture can also provide valuable insights and support during times of uncertainty.

Risk Mitigation Framework

The following table Artikels different types of risk, their potential impact, and corresponding mitigation strategies for a business operating in an emerging market. This framework is applicable across various emerging markets, but the specific strategies should be tailored to the unique circumstances of each location.

| Risk Type | Potential Impact | Mitigation Strategies | Example (Vietnam) |

|---|---|---|---|

| Political | Disruption of operations, asset seizure, policy changes | Political risk insurance, diversification of operations, strong local partnerships, contingency planning | Investing in multiple factories across different provinces to mitigate the impact of localized political unrest. |

| Economic | Inflation, currency devaluation, economic recession | Hedging strategies, local financing, diversification of revenue streams, robust financial planning | Using Vietnamese Dong denominated loans and hedging against potential USD/VND fluctuations. |

| Social | Cultural misunderstandings, labor disputes, consumer boycotts | Cultural sensitivity training, strong community engagement, fair labor practices, robust communication strategies | Employing local staff and consultants to understand local customs and sensitivities in marketing and operations. |

| Environmental | Natural disasters, pollution regulations, resource scarcity | Environmental impact assessments, sustainable practices, insurance against natural disasters, compliance with environmental regulations | Investing in flood-resistant infrastructure and adhering to stringent Vietnamese environmental regulations to minimize operational disruptions. |

Leveraging Technology and Innovation: Exploring Emerging Market Opportunities

The rapid advancement of technology is profoundly reshaping emerging markets, offering unprecedented opportunities for economic growth and development. This section explores the transformative potential of technology, focusing on its impact on specific sectors and challenges within these dynamic economies. We will examine the role of mobile technology, innovative solutions for infrastructure and logistics, and the influence of Fintech on financial inclusion.

Mobile technology’s contribution to economic growth and market access in Kenya serves as a compelling example. The widespread adoption of mobile money platforms, such as M-Pesa, has revolutionized financial transactions, enabling millions of previously unbanked individuals to participate in the formal economy.

Mobile Technology’s Impact on Economic Growth and Market Access in Kenya

M-Pesa, launched in 2007, has dramatically altered Kenya’s economic landscape. Its user-friendly interface and accessibility, even in remote areas with limited banking infrastructure, have fostered financial inclusion. This has led to increased economic activity, as individuals can easily send and receive money, pay bills, and access micro-loans. The platform has also facilitated the growth of small and medium-sized enterprises (SMEs), providing them with a secure and efficient means of conducting business. Data from Safaricom, M-Pesa’s operator, indicates millions of daily transactions, showcasing its profound impact on the Kenyan economy. The increased financial activity has, in turn, fueled economic growth and reduced reliance on cash-based transactions, improving transparency and security.

Innovative Technologies Addressing Infrastructure and Logistics Challenges

Emerging markets often grapple with inadequate infrastructure and inefficient logistics networks. However, innovative technologies offer promising solutions to overcome these hurdles. Drone technology, for example, is being utilized in several countries to deliver essential goods and medical supplies to remote and underserved areas. This bypasses traditional transportation limitations, ensuring timely access to crucial resources. Furthermore, the use of sophisticated data analytics and GPS tracking systems can optimize supply chains, reducing transportation costs and improving delivery times. Real-time tracking enables businesses to monitor shipments, anticipate potential delays, and enhance overall efficiency. In Rwanda, for instance, drone delivery services are proving effective in delivering blood supplies to hospitals in hard-to-reach areas, saving lives and improving healthcare access.

Fintech Solutions and Their Impact on Financial Inclusion and Economic Development in India

The rise of Fintech in India has significantly broadened financial access, particularly for the underserved population. Digital payment platforms, such as Paytm and PhonePe, have enabled millions to conduct financial transactions without relying on traditional banking systems. These platforms have simplified money transfers, bill payments, and online shopping, promoting financial inclusion and driving economic growth. Micro-lending platforms leverage technology to assess creditworthiness and provide small loans to individuals and SMEs, fostering entrepreneurship and economic development. The increased accessibility to financial services has empowered individuals and businesses, contributing to a more inclusive and dynamic economy. The success of these Fintech initiatives is evident in the surge in digital transactions and the growth of the Indian digital economy. For example, the substantial increase in digital payments during the COVID-19 pandemic showcased the resilience and adaptability of India’s Fintech sector.

Sustainability and Social Impact

Integrating sustainability into Exploring Emerging Market Opportunities operations presents a unique challenge and opportunity. While maximizing profit remains crucial, businesses increasingly recognize the interconnectedness of environmental stewardship, social responsibility, and long-term economic success in these dynamic contexts. A sustainable approach not only mitigates risks but also unlocks new markets and enhances brand reputation, fostering trust with consumers and stakeholders.

Businesses can successfully integrate sustainability practices by focusing on resource efficiency, waste reduction, and ethical sourcing. This involves adopting cleaner production methods, investing in renewable energy sources, and ensuring fair labor practices throughout their supply chains. Crucially, this integration must be tailored to the specific context of each emerging Exploring Emerging Market Opportunitiest, considering local regulations, cultural norms, and the unique environmental challenges present. A one-size-fits-all approach is unlikely to succeed.

Sustainable Business Practices in Emerging Markets, Exploring Emerging Market Opportunities

Implementing sustainable practices often involves a phased approach. Initial efforts might focus on readily achievable improvements, such as reducing energy consumption through more efficient equipment or improving waste management systems. Subsequent phases can involve more ambitious goals, like transitioning to renewable energy or implementing circular economy principles. This gradual approach allows businesses to manage costs effectively while demonstrating a genuine commitment to sustainability. Regular monitoring and evaluation are essential to track progress and adapt strategies as needed. Financial incentives, such as tax breaks or subsidies for green technologies, can further encourage adoption.

Examples of Successful Integration of Profit and Social Impact

Several businesses have demonstrated the potential for simultaneous profit generation and positive social impact in emerging markets. For example, a fair-trade coffee cooperative in rural Ethiopia empowers local farmers by providing them with fair prices, technical assistance, and access to credit, leading to improved livelihoods and environmental sustainability through responsible farming practices. Their success is not solely measured in financial terms but also in the positive social and environmental outcomes achieved. Similarly, a solar energy company in India provides affordable solar power to underserved communities, expanding access to electricity while simultaneously reducing reliance on polluting fossil fuels. This dual benefit of profitability and social good highlights the potential for businesses to contribute significantly to sustainable development.

The Interconnectedness of Economic Growth, Social Development, and Environmental Sustainability

Imagine a three-dimensional model. The base represents environmental sustainability, encompassing resource management, pollution control, and biodiversity conservation. The second layer, built upon the base, represents social development, encompassing factors like education, healthcare, and community well-being. These two layers support the top layer, representing economic growth, including job creation, income generation, and improved infrastructure. In an emerging market context, this model illustrates how environmental degradation can hinder social progress and economic development. Conversely, investments in environmental protection can create new economic opportunities, such as green jobs and sustainable tourism, while simultaneously improving social well-being. This interconnectedness underscores the importance of integrating sustainability considerations into all aspects of business operations in emerging markets. A strong foundation of environmental sustainability is crucial for building a resilient and prosperous economy that benefits all stakeholders.

In conclusion, successfully navigating the opportunities presented by emerging Exploring Emerging Market Opportunities requires a multifaceted approach. By carefully identifying promising markets, developing robust entry strategies, understanding consumer behavior, managing risks effectively, and leveraging technological advancements, businesses can unlock significant growth potential. Furthermore, integrating sustainability and social responsibility into their operations is not only ethically sound but also contributes to long-term success and builds strong relationships with local communities. The journey into these dynamic markets is challenging, yet the rewards for those who adapt and innovate are substantial.

Exploring emerging market opportunities requires a strategic approach. Successfully tapping into these markets hinges on identifying and engaging potential clients, which is where effective lead generation becomes crucial. Learning and implementing the strategies outlined in this helpful guide on Effective Lead Generation Techniques can significantly boost your outreach and ultimately, your success in these dynamic environments.

Ultimately, refined lead generation is key to unlocking the full potential of emerging markets.