Best Payment Gateway Options – are crucial for the success of any online business. Choosing the right gateway involves careful consideration of factors like transaction fees, security protocols, and integration capabilities with your e-commerce platform. This exploration delves into the diverse landscape of payment gateway providers, examining their features, advantages, and disadvantages to help businesses make informed decisions.

From hosted solutions offering ease of use to self-hosted options providing greater control, the options are numerous. We’ll compare popular choices like Stripe, PayPal, and Square, highlighting their strengths and weaknesses in areas such as international transaction support, security measures, and customer experience optimization. Understanding these nuances is vital for creating a smooth and secure checkout process that fosters customer trust and boosts sales.

Introduction to Best Payment Gateway Options

Best Payment Gateway Options are the essential backbone of any successful online business. They act as the secure intermediary between a merchant’s website and the customer’s bank, facilitating the processing of online payments. Without a reliable payment gateway, e-commerce transactions simply wouldn’t be possible. They handle sensitive financial data, ensuring both the merchant and the customer are protected from fraud and other security risks.

Best Payment Gateway Options streamline the checkout process, making it easier for customers to complete purchases and boosting overall sales conversions. They offer a variety of payment options, integrating seamlessly with various shopping carts and e-commerce platforms, enhancing the customer experience and contributing to a positive brand image.

Types of Payment Gateways

Payment gateways are broadly categorized into two main types: hosted and self-hosted. Hosted gateways handle the entire payment processing process on their servers, relieving merchants of the burden of managing complex security protocols and PCI compliance. Self-hosted gateways, on the other hand, require merchants to install and manage the payment processing software on their own servers, offering greater control but demanding more technical expertise and responsibility for security. The choice between these two types depends largely on the technical capabilities and resources of the merchant.

Examples of Payment Gateway Providers

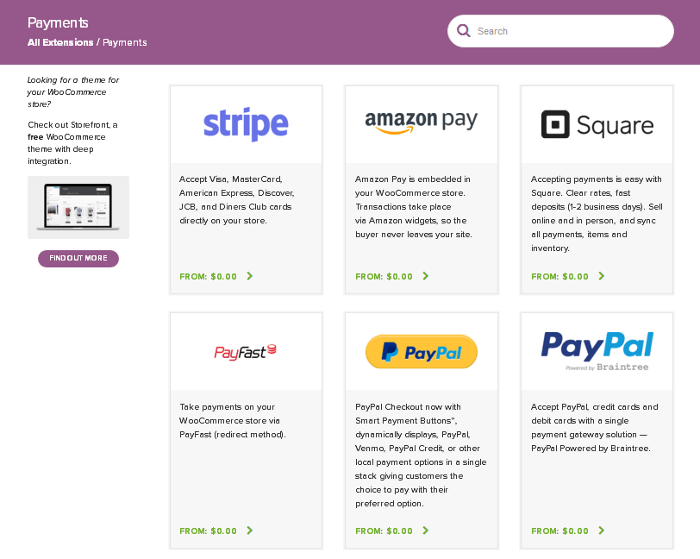

Numerous payment gateway providers cater to businesses of all sizes and types. Some of the most widely used include PayPal, Stripe, Square, Authorize.Net, and Braintree. Each provider offers a unique set of features, pricing structures, and integration options, allowing merchants to select the solution that best fits their specific needs and business model. For instance, PayPal is known for its widespread acceptance and ease of use, while Stripe is favored for its developer-friendly APIs and advanced features. Square is popular for its point-of-sale (POS) integration, and Authorize.Net boasts a long history and strong reputation in the industry.

Comparison of Popular Payment Gateways

Choosing the right payment gateway requires careful consideration of various factors. The following table compares three popular options: Stripe, PayPal, and Square.

| Feature | Stripe | PayPal | Square |

|---|---|---|---|

| Transaction Fees | Variable, depending on plan and payment method | Variable, depending on plan and payment method | Variable, depending on plan and payment method |

| Monthly Fees | Varies by plan; some plans are free | Varies by plan; some plans are free | Varies by plan; some plans are free |

| Integration Options | Extensive API integrations | Wide range of integrations | Strong POS and e-commerce integrations |

| Customer Support | Online documentation and email support; higher-tier plans offer phone support | Online documentation and phone/email support | Online documentation and phone/email support |

Factors to Consider When Choosing a Payment Gateway

Selecting the right payment gateway is crucial for any business, significantly impacting sales, customer experience, and operational efficiency. A poorly chosen gateway can lead to lost revenue, security breaches, and frustrated customers. This section Artikels key factors to consider to ensure a smooth and secure payment processing system.

Transaction Fees and Pricing Models

Payment gateway fees vary considerably, impacting your overall profitability. Understanding the different pricing structures is essential. Common models include flat-rate fees per transaction, percentage-based fees (a percentage of each transaction), and tiered pricing (fees varying based on transaction volume or processing method). Businesses should carefully compare the total cost of ownership across different gateways, factoring in setup fees, monthly fees, and potential additional charges for specific features or payment methods. For example, a business processing high volumes of low-value transactions might find a percentage-based fee structure more expensive than a flat-rate model, while the opposite could be true for a business with fewer, higher-value transactions. A detailed analysis of your anticipated transaction volume and average transaction value is crucial for making an informed decision.

Security Features and Fraud Prevention

Security is paramount when choosing a payment gateway. Look for gateways that comply with Payment Card Industry Data Security Standard (PCI DSS) and offer robust security features such as encryption (both in transit and at rest), tokenization, and advanced fraud detection systems. Features like address verification system (AVS) and card verification value (CVV) checks help minimize fraudulent transactions. The gateway should also provide regular security updates and vulnerability patching to protect against emerging threats. A gateway with a proven track record of security and a proactive approach to fraud prevention is essential for safeguarding your business and your customers’ data. For instance, a gateway employing machine learning algorithms to identify and flag suspicious transactions can significantly reduce the risk of fraudulent activity.

Supported Payment Methods

Offering a diverse range of payment options enhances customer convenience and increases conversion rates. Consider the payment methods most commonly used by your target audience. This might include major credit cards (Visa, Mastercard, American Express, Discover), debit cards, mobile wallets (Apple Pay, Google Pay, PayPal), and potentially other regional or specialized payment options. The gateway’s ability to seamlessly integrate with these methods is vital for a smooth checkout process. For example, a business targeting a younger demographic might prioritize offering mobile wallet options, while a business with an international clientele might need to support a wider array of credit and debit cards from various countries.

Integration Capabilities and API

Seamless integration with your existing e-commerce platform or point-of-sale (POS) system is crucial. Check the gateway’s compatibility with your current technology stack and assess the ease of integration. A well-documented API (Application Programming Interface) simplifies the integration process and allows for customization. A gateway with robust API documentation and readily available support resources will make the integration process smoother and less time-consuming. The availability of plugins or pre-built integrations for popular e-commerce platforms can also significantly reduce development time and cost.

PCI Compliance Best Practices

PCI DSS compliance is not just a recommendation; it’s a requirement for businesses processing credit card payments. Choose a payment gateway that actively assists in achieving and maintaining PCI compliance. This includes adhering to security standards, providing regular security assessments, and offering tools and resources to help you meet the requirements. Proactive measures, such as regular security audits and employee training programs focused on data security best practices, are essential for minimizing the risk of non-compliance and potential penalties. Failing to comply with PCI DSS can result in significant fines and reputational damage.

Specific Payment Gateway Features: Best Payment Gateway Options

Choosing the right payment gateway is crucial for any online business. This section delves into the specific features of three popular options – Stripe, PayPal, and Square – to help you make an informed decision. We will compare their functionalities, integration processes, and overall costs, providing a clear picture of their advantages and disadvantages.

Stripe, PayPal, and Square Feature Comparison

Stripe, PayPal, and Square each offer a range of features catering to different business needs and sizes. Stripe excels in its developer-friendly API and customizable options, making it ideal for businesses requiring high levels of control and integration flexibility. PayPal, a long-standing industry player, boasts widespread consumer recognition and a robust global reach. Square, known for its simplicity and ease of use, is particularly attractive to small businesses and those prioritizing a streamlined setup. While all three process major credit and debit cards, they differ in their support for alternative payment methods, international transactions, and advanced features like recurring billing and fraud prevention. Specific features such as invoicing capabilities and advanced analytics also vary.

Shopify Integration with Stripe

Integrating Stripe with Shopify, a popular e-commerce platform, is a relatively straightforward process. Shopify offers a built-in Stripe integration app, readily accessible through the Shopify app store. After installing the app, you’ll need to connect your Stripe account to your Shopify store by providing your Stripe credentials. This usually involves linking your Stripe account and selecting the payment methods you wish to offer. Once connected, Stripe automatically handles the processing of payments made on your Shopify store, providing you with a seamless and secure payment experience for your customers. The process typically involves minimal coding and can be completed within minutes, although testing is always recommended to ensure everything functions correctly.

Advantages and Disadvantages of Each Payment Gateway

Understanding the pros and cons of each gateway is essential for selecting the best fit.

Stripe:

Selecting the best payment gateway options is crucial for smooth transactions and minimizing fees. A key aspect of this involves managing your overall operational costs, which is why understanding how to effectively Optimize Your Marketing Budget is vital. By streamlining your marketing spend, you can free up resources to invest in more efficient payment processing solutions and ultimately improve your bottom line.

- Advantages: Highly customizable, robust API, excellent developer documentation, supports various currencies and payment methods, advanced fraud prevention tools.

- Disadvantages: Steeper learning curve for non-technical users, potentially higher setup costs for complex integrations.

PayPal:

- Advantages: Wide consumer recognition, global reach, easy setup and integration, buyer protection program.

- Disadvantages: Higher transaction fees compared to some competitors, limited customization options, less developer-friendly API.

Square:

Choosing the best payment gateway options for your online business is crucial for smooth transactions. However, simply having a great payment system isn’t enough; you need customers to find you! Driving traffic to your site requires effective strategies, and that’s where learning about SEO Tricks for Better Traffic becomes vital. Ultimately, optimizing your site for search engines complements a robust payment gateway, maximizing your sales potential.

- Advantages: Simple and user-friendly interface, easy setup, integrated POS system, competitive pricing for small businesses.

- Disadvantages: Fewer advanced features compared to Stripe and PayPal, limited customization options for larger businesses.

Calculating the Total Cost of Using Stripe

Stripe’s pricing structure is primarily based on transaction fees. These fees vary depending on the payment method and your location. For example, in the US, the standard transaction fee for processing a credit card payment might be 2.9% + $0.30 per transaction. There are no monthly fees for basic usage, but additional fees might apply for certain features like recurring billing or international transactions.

To calculate the total cost, consider the following formula: Total Cost = (Transaction Fee Percentage * Total Transaction Value) + (Fixed Fee per Transaction * Number of Transactions) + Monthly Fees (if any) + Additional Feature Fees (if any)

For instance, if you process $10,000 in transactions in a month with 100 transactions, the cost would be: ($10,000 * 0.029) + ($0.30 * 100) = $290 + $30 = $320. This calculation assumes no additional fees for premium features or monthly charges. Always refer to the latest pricing information on Stripe’s official website for the most up-to-date figures.

International Payment Processing

Expanding your business internationally opens doors to new markets and increased revenue, but it also introduces complexities in payment processing. Successfully navigating these complexities requires a deep understanding of the challenges involved and a strategic selection of payment gateway solutions. This section will explore the key considerations for processing international payments and highlight solutions to help your business thrive globally.

International payment processing presents unique challenges compared to domestic transactions. Currency conversion rates fluctuate, impacting profitability and requiring careful management. Different countries have varying regulatory requirements and compliance standards, demanding meticulous attention to detail. Furthermore, cross-border transactions can be subject to higher fraud rates, necessitating robust security measures. Finally, varying customer preferences for payment methods in different regions necessitate offering a diverse range of options.

Challenges of International Payment Processing

International transactions face several hurdles. Firstly, fluctuating exchange rates introduce uncertainty into the final transaction value. Secondly, each country possesses its own regulatory framework, including tax laws and anti-money laundering (AML) regulations. Compliance with these diverse regulations is crucial to avoid legal issues and penalties. Thirdly, cross-border transactions are often more susceptible to fraud, demanding sophisticated fraud prevention mechanisms. Lastly, different regions prefer different payment methods; offering a limited selection can significantly hinder international sales.

Considerations for Businesses Operating in Multiple Countries

Businesses operating across borders must carefully consider several factors. Firstly, a thorough understanding of local regulations and compliance requirements is paramount. This includes knowledge of tax laws, data privacy regulations (such as GDPR), and AML regulations. Secondly, selecting a payment gateway capable of supporting multiple currencies and payment methods is essential. The gateway should seamlessly handle currency conversions and offer a variety of payment options to cater to local preferences. Thirdly, implementing robust fraud prevention measures is crucial to mitigate the increased risk of fraudulent transactions. Finally, providing multilingual customer support enhances the customer experience and builds trust.

Payment Gateways Supporting Multiple Currencies and Regions, Best Payment Gateway Options

Several Best Payment Gateway Options cater specifically to international businesses. PayPal, for instance, supports numerous currencies and offers cross-border payment solutions. Stripe is another popular option, providing robust international payment processing capabilities and a wide range of payment methods. Worldpay offers similar functionality, with a strong focus on global reach and compliance. These gateways typically offer features such as automated currency conversion, multi-currency accounts, and localized payment options. The specific features and fees vary among providers, so careful comparison is recommended.

International Transaction Processing Flowchart

The following describes a simplified flowchart illustrating the steps involved in processing an international transaction:

[Imagine a flowchart here. The flowchart would begin with a customer initiating a purchase from an international website. The next step would show the request being sent to the payment gateway. The gateway would then verify the payment details and check for fraud. If successful, the gateway would convert the currency and transfer the funds to the merchant’s account. The final step would be confirmation of payment to both the customer and the merchant.] The process involves customer initiation, gateway verification, currency conversion, fund transfer, and final confirmation. Each step involves specific checks and balances to ensure security and compliance.

Security and Compliance

Choosing a payment gateway involves a critical assessment of its security infrastructure and compliance with industry regulations. Reputable gateways prioritize the protection of sensitive financial data, employing robust measures to minimize risks and maintain customer trust. Understanding these security aspects is paramount for businesses seeking to establish a secure and reliable online payment system.

Data encryption and tokenization are fundamental security mechanisms employed by payment gateways. These methods transform sensitive data, rendering it unreadable to unauthorized individuals, even if a breach occurs. This protection safeguards customer information and prevents fraudulent activities.

Data Encryption and Tokenization

Data encryption involves converting sensitive data into an unreadable format using cryptographic algorithms. This ensures that even if the data is intercepted, it remains inaccessible without the decryption key. Tokenization replaces sensitive data, such as credit card numbers, with non-sensitive substitutes called tokens. These tokens can be used for transactions without revealing the actual card details. This minimizes the risk of data breaches significantly, as compromised tokens are essentially useless to attackers. For example, a payment gateway might encrypt a customer’s credit card number using AES-256 encryption before transmitting it to the payment processor. Subsequently, the system might replace the actual card number with a unique token for all future transactions, protecting the original data.

Examples of Best Payment Gateway Options security Breaches and Consequences

While reputable gateways employ stringent security measures, breaches can still occur. A well-known example involves a vulnerability exploited in a payment gateway’s system, leading to the compromise of customer credit card information. The consequences of such a breach can be severe, including financial losses for customers, reputational damage for the business using the gateway, and hefty fines for non-compliance with regulations like PCI DSS. The cost of remediation, legal fees, and loss of customer trust can significantly impact the affected entities. In some cases, a single breach can lead to the closure of the affected business.

Best Practices for Maintaining Secure Payment Processing

Maintaining secure payment processing requires a multi-faceted approach. The following best practices are essential:

- Regularly update software and security patches to address known vulnerabilities.

- Implement strong password policies and multi-factor authentication to protect access to payment gateway accounts.

- Conduct regular security audits and penetration testing to identify and address potential weaknesses.

- Educate employees on security best practices and phishing awareness to prevent social engineering attacks.

- Comply with relevant industry regulations, such as PCI DSS, to ensure adherence to security standards.

- Utilize robust fraud detection and prevention tools to identify and mitigate suspicious transactions.

- Monitor transaction activity for any anomalies that might indicate a breach.

- Maintain a comprehensive incident response plan to effectively manage and contain security incidents.

Customer Experience

The choice of payment gateway significantly impacts the customer experience, influencing conversion rates, customer loyalty, and overall brand perception. A poorly designed or unreliable payment process can lead to cart abandonment and frustrated customers, while a seamless and intuitive experience fosters trust and encourages repeat purchases. Optimizing the checkout process is crucial for maximizing sales and building a positive brand image.

A seamless and user-friendly checkout process is paramount for a positive customer experience. Customers expect a quick, easy, and secure payment experience. A lengthy or confusing checkout process can lead to frustration and cart abandonment, resulting in lost revenue. Conversely, a streamlined checkout process can increase conversion rates and enhance customer satisfaction. This requires careful consideration of factors such as page load times, form design, and available payment methods.

Payment Gateway Features Enhancing Customer Experience

Several features offered by various payment gateways directly contribute to a superior customer experience. These features aim to simplify the payment process and reduce friction points for the buyer. For example, features that simplify the process and make it faster contribute greatly to a positive customer experience.

- One-Click Checkout: This feature allows returning customers to complete purchases with a single click, eliminating the need to repeatedly enter payment and shipping information. This significantly speeds up the checkout process and improves convenience.

- Mobile Optimization: With the increasing prevalence of mobile commerce, a payment gateway must be fully optimized for mobile devices. This ensures a consistent and user-friendly experience across all platforms, regardless of whether the customer is using a desktop computer, tablet, or smartphone.

- Multiple Payment Options: Offering a variety of payment methods, such as credit cards, debit cards, PayPal, Apple Pay, and Google Pay, caters to different customer preferences and increases the likelihood of a successful transaction. This broadens the appeal to a wider range of customers.

- Guest Checkout: Allowing customers to make purchases without creating an account reduces friction and speeds up the checkout process, particularly for one-time buyers. This minimizes the steps needed to complete a purchase.

- Clear and Concise Information: The checkout process should be clear, concise, and easy to understand. Avoid jargon and unnecessary information that could confuse the customer. Transparency regarding fees and processing times is essential.

Ideal Checkout Process User Interface Mockup

Imagine a checkout page with a clean and modern design. The page is divided into clear sections:

1. Order Summary: This section displays a concise summary of the items in the cart, including quantity, price, and any applicable discounts. The total amount due is clearly highlighted. This section should use a visually appealing format, perhaps with clear images of the products.

2. Shipping Information: This section allows customers to enter or select their shipping address. Auto-fill functionality for returning customers is a significant advantage. Clear labeling of each field is crucial. The section should allow for easy editing and correction of the information.

3. Payment Information: This section provides various payment options (credit card, PayPal, etc.) with clear visual cues indicating which payment method is selected. The section should provide security assurances and badges to instill trust. The layout should be intuitive and simple to use.

4. Order Review and Confirmation: Before finalizing the purchase, a summary of the order (items, shipping address, payment method, total cost) is displayed for final review. This allows the customer to double-check the information before submitting the order.

5. Order Confirmation: Upon successful order submission, a clear confirmation message with an order number is displayed. This message should reassure the customer that their order has been placed successfully. A follow-up email confirmation is essential.

The overall design should be visually appealing, easy to navigate, and optimized for various screen sizes. The use of whitespace and clear typography improves readability and reduces visual clutter. The color scheme should be consistent with the brand’s overall aesthetic. Progress indicators, such as a progress bar, can help the customer understand the stages of the checkout process. Error messages should be clear, concise, and helpful, guiding the customer towards a successful transaction.

Ultimately, selecting the best Best Payment Gateway Options a business’s specific needs and priorities. By carefully weighing factors such as transaction costs, security features, international capabilities, and customer experience considerations, businesses can choose a gateway that aligns perfectly with their goals. A well-chosen payment gateway not only facilitates secure transactions but also contributes significantly to a positive customer journey, ultimately driving business growth and success.