Corporate governance strategy is crucial for organizational success and long-term sustainability. It establishes a framework for ethical decision-making, risk management, and stakeholder engagement, fostering trust and accountability. This guide explores the core principles of effective corporate governance, examining its various components and their practical implications for businesses of all sizes.

We will delve into the roles and responsibilities of key stakeholders, including the board of directors, management, and shareholders, highlighting the importance of aligning their interests to achieve common goals. The discussion will also cover risk mitigation strategies, ethical considerations, legal compliance, and methods for monitoring and evaluating governance effectiveness. Ultimately, understanding and implementing a robust corporate governance strategy is key to building a resilient and responsible organization.

Defining Corporate Governance Strategy

Corporate governance strategy Artikels the framework by which a company is directed and controlled. It ensures accountability to shareholders and other stakeholders, promoting ethical behavior and long-term sustainability. A well-defined strategy fosters trust, transparency, and ultimately, increased value for the organization.

Core Principles of Effective Corporate Governance

Effective corporate governance rests on several fundamental principles. These principles aim to establish a balance between the interests of various stakeholders, including shareholders, employees, customers, and the community. They provide a roadmap for responsible decision-making and risk management. Key principles include fairness, accountability, responsibility, transparency, and independence. Fairness ensures equitable treatment of all stakeholders; accountability holds individuals responsible for their actions; responsibility emphasizes the duty of care owed to the company; transparency promotes open communication and disclosure; and independence safeguards against conflicts of interest.

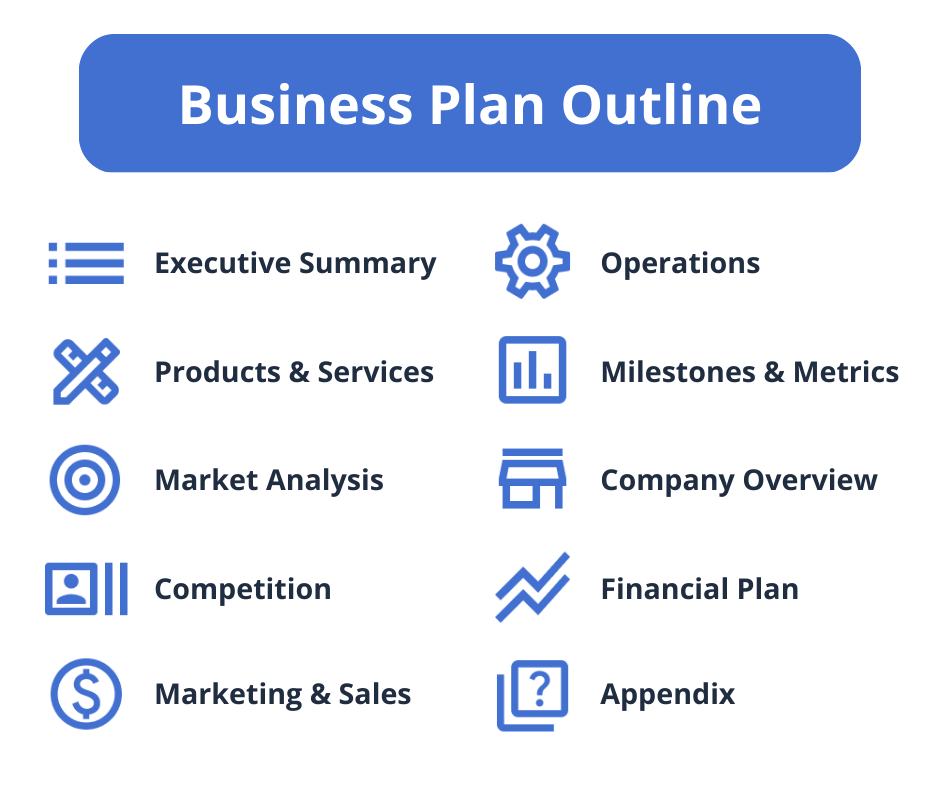

Key Components of a Robust Corporate Governance Strategy

A robust corporate governance strategy encompasses several key components working in concert. These components ensure that the company operates ethically, efficiently, and effectively, minimizing risks and maximizing opportunities. These include a clearly defined organizational structure, a well-defined board of directors with clear responsibilities, robust risk management processes, a comprehensive code of ethics, effective internal controls, and transparent financial reporting. Each component plays a crucial role in achieving good governance. For instance, a strong internal control system helps prevent fraud and error, while transparent financial reporting builds trust with investors.

Examples of Different Corporate Governance Structures and Their Implications

Different corporate governance structures exist, each with its own implications for how a company is managed and controlled. One common structure is the unitary board, where all directors serve on a single board responsible for both strategic and operational oversight. Another is the two-tier board, which separates supervisory and management functions into distinct boards. A unitary board offers simplicity and efficiency, but can potentially lead to conflicts of interest if not managed effectively. A two-tier board provides stronger separation of powers, enhancing oversight and reducing conflicts, but can add complexity and potentially slow down decision-making. The choice of structure depends on factors like company size, industry, and regulatory environment. For example, larger, publicly traded companies often opt for a two-tier board to enhance transparency and accountability to shareholders.

Roles and Responsibilities of the Board of Directors, Management, and Shareholders

The roles and responsibilities of the board of directors, management, and shareholders are distinct yet interconnected. The board of directors provides strategic direction, oversees management, and ensures accountability to shareholders. Management is responsible for the day-to-day operations of the company and implementing the board’s strategic decisions. Shareholders, as owners, elect the board and hold it accountable for the company’s performance. A clear delineation of these roles is crucial for effective corporate governance. For example, the board should not micromanage the day-to-day operations, leaving that to management. Conversely, management should keep the board informed of significant developments and seek its guidance on strategic issues. Shareholders, through their voting rights and engagement with the company, exert influence over both the board and management.

Risk Management within Corporate Governance

Effective corporate governance is inextricably linked to robust risk management. A strong governance framework provides the structure and oversight necessary to identify, assess, and mitigate potential risks that could threaten an organization’s long-term sustainability and success. Ignoring risk management within a corporate governance structure leaves the organization vulnerable to significant financial and reputational damage.

Potential Risks Associated with Weak Corporate Governance

Weak corporate governance creates a breeding ground for various risks. These risks can manifest across numerous areas, impacting financial performance, operational efficiency, and stakeholder relationships. For instance, inadequate board oversight can lead to poor strategic decision-making, resulting in missed opportunities or costly errors. Similarly, a lack of transparency and accountability can foster unethical behavior, such as fraud or corruption, leading to significant financial losses and legal repercussions. Furthermore, insufficient risk assessment processes can leave the organization exposed to unforeseen events, such as market downturns or cybersecurity breaches. Finally, a failure to adequately manage conflicts of interest can damage the organization’s reputation and erode stakeholder trust.

Strategies for Mitigating Governance-Related Risks

Mitigating governance-related risks requires a multi-faceted approach. This includes establishing clear roles and responsibilities within the organization, ensuring that the board of directors possesses the necessary skills and experience to provide effective oversight, and fostering a culture of ethical behavior and accountability. Regular and thorough risk assessments are crucial, enabling the identification of potential threats before they materialize. Implementing effective internal controls, such as segregation of duties and robust financial reporting systems, helps to prevent and detect fraudulent activities. Moreover, establishing a comprehensive compliance program, including regular audits and training for employees, ensures adherence to relevant laws and regulations. Finally, fostering open communication channels between management, the board, and stakeholders promotes transparency and accountability, contributing to a more resilient and responsible organization.

The Importance of Internal Controls and Compliance Programs

Internal controls and compliance programs are fundamental pillars of effective risk management within corporate governance. Internal controls are processes designed to ensure the reliability of financial reporting, the effectiveness and efficiency of operations, and compliance with laws and regulations. These controls range from simple checks and balances to sophisticated automated systems. A robust compliance program involves establishing clear policies and procedures, conducting regular training for employees, and implementing monitoring mechanisms to ensure adherence to legal and ethical standards. The effectiveness of both internal controls and compliance programs depends heavily on the commitment and engagement of senior management and the board of directors. Failure to implement and maintain effective internal controls and compliance programs exposes the organization to significant financial, operational, and reputational risks.

Framework for Assessing and Managing Governance-Related Risks

A structured framework is essential for effectively assessing and managing governance-related risks. This framework should incorporate the following key elements: risk identification, risk assessment, risk response planning, risk monitoring, and reporting. Risk identification involves systematically identifying potential risks that could impact the organization. Risk assessment involves evaluating the likelihood and potential impact of each identified risk. Risk response planning involves developing strategies to mitigate or address identified risks, including avoidance, reduction, transfer, and acceptance. Risk monitoring involves regularly tracking and evaluating the effectiveness of implemented risk response plans. Finally, reporting involves regularly communicating risk-related information to the board of directors and other relevant stakeholders. This cyclical process ensures ongoing adaptation to changing circumstances and emerging threats.

Comparison of Risk Mitigation Techniques

| Risk Mitigation Technique | Description | Advantages | Disadvantages |

|---|---|---|---|

| Risk Avoidance | Not engaging in activities that present significant risks. | Eliminates potential losses. | May limit opportunities for growth and innovation. |

| Risk Reduction | Implementing controls to reduce the likelihood or impact of a risk. | Reduces the probability and severity of losses. | Can be costly and time-consuming. |

| Risk Transfer | Shifting the risk to a third party, such as through insurance. | Transfers financial responsibility for losses. | Can be expensive and may not cover all losses. |

| Risk Acceptance | Accepting the risk and its potential consequences. | Avoids unnecessary costs associated with mitigation. | May result in significant losses if the risk materializes. |

Stakeholder Engagement and Communication

Effective stakeholder engagement and communication are crucial for successful corporate governance. A well-defined strategy fosters trust, transparency, and ultimately, a more sustainable and resilient organization. Open dialogue and proactive communication build strong relationships, enabling the company to anticipate and address potential challenges collaboratively.

A robust stakeholder engagement strategy considers the unique needs and expectations of each group, tailoring communication methods and channels accordingly. It involves not just disseminating information, but actively soliciting feedback and integrating it into decision-making processes. This two-way communication strengthens the relationship between the organization and its stakeholders, resulting in better governance and improved business outcomes.

A robust corporate governance strategy is crucial for any business, ensuring ethical practices and accountability. This is particularly relevant when considering scalable business models like the Dropshipping business model , where transparency and efficient supply chain management are paramount. Strong governance frameworks help mitigate risks associated with third-party suppliers and maintain customer trust, ultimately bolstering the long-term success of the company.

Best Practices for Engaging with Various Stakeholders

Engaging diverse stakeholders requires a multi-faceted approach. Different groups have varying communication preferences and priorities. Understanding these nuances is key to building effective relationships.

- Employees: Regular town halls, internal communication platforms, employee surveys, and feedback mechanisms allow for open dialogue and address concerns promptly. Examples include using internal wikis for policy updates and conducting anonymous surveys to gauge employee sentiment on governance matters.

- Customers: Customer satisfaction surveys, social media monitoring, and direct engagement through feedback forms provide valuable insights into customer perceptions of the company’s governance practices. Responding promptly to negative feedback and demonstrating a commitment to ethical business practices builds trust.

- Investors: Regular investor calls, annual reports, ESG (Environmental, Social, and Governance) disclosures, and presentations at investor conferences provide transparency and maintain investor confidence. Active participation in investor relations activities and clear communication regarding financial performance and governance policies are essential.

Methods for Transparent and Effective Communication of Corporate Governance Policies

Transparency is paramount in corporate governance. Clear, concise, and accessible communication ensures that stakeholders understand the company’s policies and practices.

- Website: A dedicated section on the company website detailing corporate governance policies, codes of conduct, and sustainability initiatives provides readily available information. This should include clear and simple explanations of complex topics.

- Annual Reports: Comprehensive annual reports should include a dedicated section on corporate governance, outlining the company’s approach to risk management, stakeholder engagement, and ethical conduct. These reports should be easily accessible to all stakeholders.

- Training Programs: Internal training programs for employees on corporate governance policies ensure that everyone understands their responsibilities and the importance of ethical conduct. This fosters a culture of compliance and accountability.

Addressing Stakeholder Concerns and Feedback

A formal process for addressing stakeholder concerns and feedback is crucial for building trust and fostering constructive dialogue. This involves establishing clear channels for communication and ensuring timely responses.

- Dedicated Communication Channels: Establishing dedicated email addresses, helplines, or online portals allows stakeholders to easily submit their concerns and feedback.

- Response Protocols: Clear protocols for acknowledging and responding to stakeholder concerns ensure timely and appropriate action. This includes setting deadlines for responses and providing updates on progress.

- Feedback Mechanisms: Regularly reviewing stakeholder feedback to identify trends and areas for improvement helps refine corporate governance practices and enhance stakeholder satisfaction.

Building Trust and Confidence Among Stakeholders

Building and maintaining trust requires consistent demonstration of ethical behavior, transparency, and accountability. Open communication and responsiveness to stakeholder concerns are key elements in this process.

- Consistent Actions: Aligning words with actions demonstrates commitment to ethical conduct and builds stakeholder confidence. Inconsistency erodes trust quickly.

- Accountability: Establishing mechanisms for accountability for governance failures ensures that stakeholders know that their concerns are taken seriously and that appropriate action will be taken.

- Proactive Communication: Proactively communicating both positive and negative developments builds trust by demonstrating transparency and a commitment to open dialogue.

Examples of Effective Stakeholder Engagement Initiatives

Many companies have successfully implemented stakeholder engagement initiatives. These examples illustrate the diverse approaches that can be used.

A robust corporate governance strategy is crucial for long-term success. Effective governance ensures that decisions are made ethically and transparently, leading to better outcomes. A key component of this is efficient Strategic resource allocation , which directly impacts a company’s ability to achieve its objectives. Ultimately, sound resource allocation, guided by strong governance, maximizes value creation and minimizes risk for all stakeholders.

- Unilever’s Sustainable Living Plan: This initiative engages stakeholders by setting ambitious sustainability targets and regularly reporting on progress. It actively involves employees, customers, and investors in achieving these goals.

- Patagonia’s commitment to environmental responsibility: Patagonia’s transparent communication about its environmental impact and its commitment to sustainability resonates strongly with environmentally conscious consumers and investors. This builds trust and brand loyalty.

- Microsoft’s Diversity and Inclusion initiatives: Microsoft’s focus on diversity and inclusion demonstrates a commitment to ethical and equitable practices, enhancing its reputation among employees, customers, and investors who value these principles.

Ethical Considerations and Corporate Social Responsibility

Ethical considerations and corporate social responsibility (CSR) are fundamental pillars of robust corporate governance. A strong governance framework not only ensures legal compliance but also fosters a culture of integrity, transparency, and accountability, ultimately benefiting all stakeholders. Ignoring these ethical dimensions can lead to reputational damage, legal repercussions, and a loss of stakeholder trust.

Ethical Implications of Corporate Governance Decisions

Corporate governance decisions, from executive compensation to environmental policies, carry significant ethical weight. Decisions should be guided by principles of fairness, justice, and respect for human rights. For instance, a decision to outsource manufacturing to a country with lax labor laws raises ethical concerns about worker exploitation. Similarly, prioritizing short-term profits over long-term sustainability impacts the environment and future generations. Ethical decision-making requires careful consideration of the potential consequences for all stakeholders, including employees, customers, suppliers, communities, and the environment. A robust ethical framework helps navigate these complex scenarios and promotes responsible decision-making.

The Role of Corporate Social Responsibility (CSR) in a Strong Governance Framework

CSR is not merely a public relations exercise; it is an integral component of effective corporate governance. It demonstrates a company’s commitment to operating ethically and sustainably, contributing to the well-being of society and the environment. A strong CSR program aligns a company’s values with its operations, fostering a culture of responsibility and accountability. This includes initiatives related to environmental sustainability, human rights, community engagement, and ethical sourcing. Companies with strong CSR programs often experience improved brand reputation, increased investor confidence, and enhanced employee morale. For example, Patagonia’s commitment to environmental sustainability has enhanced its brand image and attracted environmentally conscious consumers.

Diversity and Inclusion in Corporate Governance

Diversity and inclusion are crucial for effective corporate governance. A diverse boardroom brings a wider range of perspectives, experiences, and expertise, leading to better decision-making and risk management. Diverse teams are more innovative and better equipped to understand the needs of a diverse customer base. Furthermore, inclusivity ensures that all voices are heard and valued, promoting a more equitable and just workplace. Companies that prioritize diversity and inclusion often demonstrate improved financial performance and enhanced stakeholder relationships. Research consistently shows a correlation between diverse leadership teams and higher profitability.

Potential Conflicts of Interest and Methods for Addressing Them

Conflicts of interest can arise when an individual’s personal interests clash with their professional responsibilities. This can occur at all levels of an organization, from the boardroom to individual employees. Potential conflicts might involve financial interests, family relationships, or personal biases. To mitigate these risks, companies should implement robust conflict-of-interest policies, including disclosure requirements, independent oversight, and transparent decision-making processes. Regular training and ethical awareness programs can also help employees identify and address potential conflicts. Independent audits and external reviews can further strengthen the effectiveness of conflict-of-interest management.

Ethical Considerations Checklist for Corporate Governance

Before making any significant corporate governance decision, it’s vital to review a checklist to ensure ethical considerations are thoroughly addressed. This checklist should include considerations such as:

- Fairness and equity in all decisions.

- Compliance with all applicable laws and regulations.

- Transparency and accountability in all actions.

- Respect for human rights and dignity.

- Environmental sustainability and responsibility.

- Commitment to diversity and inclusion.

- Mitigation of potential conflicts of interest.

- Protection of stakeholder interests.

- Long-term value creation over short-term gains.

- Open communication and stakeholder engagement.

This checklist serves as a reminder of the broad ethical responsibilities inherent in sound corporate governance. Regular review and updates are necessary to ensure its continued relevance and effectiveness.

Monitoring and Evaluation of Corporate Governance

Effective monitoring and evaluation are crucial for ensuring a corporate governance strategy remains relevant, robust, and aligned with the organization’s strategic goals. A well-designed system allows for continuous improvement and adaptation to changing circumstances, ultimately enhancing organizational performance and stakeholder trust. This section Artikels key aspects of establishing a comprehensive monitoring and evaluation framework.

System Design for Monitoring Corporate Governance Strategy Effectiveness

A robust monitoring system requires a multi-faceted approach. It should encompass regular assessments of the governance framework’s alignment with legal and regulatory requirements, industry best practices, and the organization’s specific risk profile. Key components include establishing clear metrics, utilizing diverse data sources (board meeting minutes, internal audits, risk assessments, stakeholder feedback), and implementing a structured reporting process. This allows for timely identification of gaps or weaknesses in the governance structure and facilitates proactive corrective actions. The system should also consider utilizing technology to streamline data collection and analysis, improving efficiency and accuracy.

Methods for Evaluating Board and Management Performance

Evaluating board and management performance requires a balanced scorecard approach, considering both qualitative and quantitative factors. Qualitative assessments may involve peer reviews, self-evaluations, and independent assessments of board effectiveness. These evaluations should assess the board’s strategic oversight, risk management capabilities, and commitment to ethical conduct. Quantitative measures could include the achievement of strategic goals, financial performance indicators (e.g., return on equity, shareholder value), and compliance metrics. Regular performance reviews, coupled with constructive feedback mechanisms, are essential for driving continuous improvement. The evaluation process should be transparent and objective, ensuring fairness and accountability.

Key Performance Indicators (KPIs) for Measuring Governance Effectiveness

Several KPIs can effectively measure governance effectiveness. These include: the frequency and quality of board meetings; the timeliness and accuracy of financial reporting; the effectiveness of risk management processes (measured by the number and severity of risk incidents); the level of stakeholder satisfaction (measured through surveys and feedback mechanisms); the number and nature of ethical breaches; and the organization’s overall compliance rate. Tracking these KPIs over time provides valuable insights into the effectiveness of the governance framework and highlights areas requiring attention. The specific KPIs selected should be tailored to the organization’s size, industry, and strategic objectives.

Importance of Regular Reviews and Adjustments

The corporate governance landscape is constantly evolving due to changes in regulations, best practices, and the organization’s own strategic direction. Therefore, regular reviews of the governance strategy are paramount. These reviews should not be merely perfunctory exercises; instead, they should involve a critical assessment of the effectiveness of the existing framework, identification of potential weaknesses, and development of actionable improvements. The frequency of these reviews should be determined by the organization’s specific context but should be conducted at least annually, with more frequent reviews undertaken if significant changes occur within the organization or its external environment. The results of these reviews should be documented and used to inform strategic adjustments to the governance strategy.

Reporting on Governance Performance to Stakeholders

Transparent and regular reporting on governance performance is crucial for maintaining stakeholder trust and confidence. The reporting process should be tailored to the needs and expectations of different stakeholder groups (investors, employees, customers, regulators). Reports should include a summary of the organization’s governance structure, key performance indicators, and significant governance-related events. The reporting format can vary from formal annual reports to more concise updates for specific stakeholders. The organization should also consider establishing channels for open communication and feedback regarding its governance practices. This transparency fosters accountability and builds a strong reputation for ethical and responsible conduct.

Legal and Regulatory Compliance

Effective corporate governance necessitates strict adherence to all applicable laws and regulations. Failure to do so can lead to significant financial penalties, reputational damage, and even criminal prosecution. This section Artikels the key legal and regulatory requirements, the consequences of non-compliance, and the processes for ensuring ongoing compliance.

Relevant Legal and Regulatory Requirements

The specific legal and regulatory requirements impacting corporate governance vary significantly depending on factors such as industry, jurisdiction, and company size. However, common areas of focus include securities laws (governing transparency and disclosure), corporate law (defining the structure and responsibilities of the board of directors and management), environmental regulations (relating to pollution control and resource management), employment laws (covering fair labor practices and workplace safety), and antitrust laws (preventing anti-competitive behavior). International organizations like the OECD also provide guidelines that influence national regulations. For example, the Sarbanes-Oxley Act of 2002 in the United States significantly impacted corporate governance practices, particularly concerning financial reporting and internal controls. Similarly, the UK Corporate Governance Code provides a framework for listed companies.

Consequences of Non-Compliance, Corporate governance strategy

Non-compliance can result in a wide range of severe consequences. Financial penalties can be substantial, often proportionate to the severity and duration of the violation. Reputational damage can lead to loss of investor confidence, decreased market share, and difficulty attracting and retaining talent. Legal action, including lawsuits from shareholders, customers, or regulators, can result in significant financial liabilities. In extreme cases, non-compliance can lead to criminal charges against company officers and directors. For instance, a company failing to comply with environmental regulations might face hefty fines, costly remediation efforts, and damage to its brand image, impacting its ability to secure future contracts.

Processes for Ensuring Compliance

Establishing robust compliance processes is crucial. This involves a multi-faceted approach including: developing a comprehensive compliance program that clearly defines roles, responsibilities, and procedures; providing regular training to employees on relevant laws and regulations; implementing internal controls to monitor compliance; conducting regular audits to identify and address potential risks; and establishing a clear reporting mechanism for potential violations. A dedicated compliance officer or team is often responsible for overseeing these processes. Regular updates to the compliance program are essential to reflect changes in legislation and best practices.

Role of Internal Audit in Ensuring Compliance

Internal audit plays a vital role in ensuring compliance. Independent of management, internal audit provides objective assurance to the board that the company’s risk management and control systems are effective in mitigating compliance risks. This includes conducting regular audits of compliance programs, reviewing internal controls, and reporting findings to the audit committee. Internal audit’s independence is crucial to its effectiveness in identifying and reporting potential compliance breaches without fear of retribution. The internal audit function should also be involved in the design and implementation of new compliance procedures.

Summary of Key Legal and Regulatory Obligations

- Adherence to securities laws regarding transparency and disclosure of financial information.

- Compliance with corporate law regarding board structure, director responsibilities, and shareholder rights.

- Observance of environmental regulations concerning pollution control and resource management.

- Compliance with employment laws concerning fair labor practices and workplace safety.

- Adherence to antitrust laws to prevent anti-competitive behavior.

- Compliance with data protection laws regarding the handling of personal information.

Board Effectiveness and Composition

A high-performing board of directors is crucial for the long-term success and sustainability of any organization. Its effectiveness hinges on a carefully considered composition, a robust selection process, and a commitment to ongoing evaluation and improvement. This section explores the key elements contributing to board effectiveness and the optimal composition of a board.

Characteristics of a High-Performing Board

High-performing boards are characterized by a strong collective understanding of the organization’s strategic direction, a proactive approach to risk management, and a commitment to open and transparent communication. Members actively engage in constructive dialogue, offering diverse perspectives and challenging assumptions. They possess a deep understanding of the organization’s industry, its competitive landscape, and its financial performance. Furthermore, they demonstrate a strong commitment to ethical conduct and corporate social responsibility. A culture of trust and mutual respect fosters effective decision-making and collaboration.

Importance of Board Diversity and Independence

Board diversity encompasses a range of characteristics, including gender, race, ethnicity, age, professional background, and experience. A diverse board brings a wider range of perspectives, experiences, and expertise to strategic decision-making, leading to more informed and well-rounded decisions. Independent directors, those without material relationships with the organization, provide objective oversight and challenge management’s proposals, enhancing accountability and reducing the risk of conflicts of interest. Research consistently demonstrates a positive correlation between board diversity and financial performance. For example, a study by McKinsey found that companies with more diverse leadership teams were more likely to outperform their peers.

Process for Selecting and Appointing Board Members

The process of selecting and appointing board members typically involves a thorough search, a rigorous evaluation of candidates, and a transparent appointment process. A nominating committee, often composed of independent directors, identifies potential candidates, assessing their skills, experience, and suitability for the board. This may involve background checks, reference checks, and interviews. The final selection is usually approved by the full board or by shareholders, ensuring accountability and transparency. The selection criteria should align with the organization’s strategic goals and the skills and expertise needed to guide the organization effectively.

Effective Board Evaluation Processes

Regular and comprehensive board evaluations are essential for assessing the board’s effectiveness and identifying areas for improvement. These evaluations typically involve self-assessments by board members, feedback from management, and possibly external assessments by independent consultants. Evaluations should focus on the board’s performance in key areas such as strategic planning, risk oversight, financial performance monitoring, and communication. The results of the evaluation should be used to develop action plans to address identified weaknesses and enhance the board’s effectiveness. For instance, a board might identify a need for enhanced training in a specific area, such as cybersecurity or environmental, social, and governance (ESG) issues.

Ideal Board Composition: Skills and Expertise

An ideal board composition balances diverse perspectives with relevant expertise. The board should include individuals with strong financial acumen, strategic planning capabilities, industry knowledge, and legal and regulatory expertise. Other crucial skills include risk management, communication, and leadership. The specific composition will vary depending on the organization’s size, industry, and strategic priorities. For example, a technology company might prioritize board members with experience in software development and digital transformation, while a financial institution might seek individuals with deep expertise in risk management and regulatory compliance. A well-structured board ensures a balance of skills and perspectives to effectively guide the organization.

Executive Compensation and Incentives

Effective executive compensation is crucial for attracting and retaining top talent, aligning leadership incentives with company goals, and ultimately driving shareholder value. A well-designed compensation plan fosters a culture of performance and accountability, contributing significantly to long-term organizational success. Poorly designed plans, however, can lead to excessive risk-taking, short-term focus, and even ethical breaches.

Principles of Fair and Effective Executive Compensation Plans

Fair and effective executive compensation plans should be transparent, consistent with market practices, and clearly linked to performance. Key principles include establishing a clear connection between compensation and the achievement of pre-defined goals, ensuring that compensation is competitive with similar roles in the industry, and maintaining a balance between fixed and variable pay to incentivize both short-term and long-term performance. The plans should also be regularly reviewed and adjusted to reflect changes in the market and the company’s performance. Transparency builds trust and reduces potential conflicts of interest.

Aligning Executive Compensation with Company Performance

Alignment of executive compensation with company performance is paramount. This ensures that executives are rewarded for contributing to the company’s success and are penalized, at least partially, for underperformance. This alignment can be achieved through the use of performance-based bonuses, stock options, and other equity-based incentives. For instance, a company might tie a significant portion of an executive’s compensation to the achievement of specific financial targets, such as revenue growth, profitability, or return on equity. Furthermore, long-term incentives, such as stock options with vesting periods, encourage executives to focus on the long-term health and sustainability of the company. Conversely, failure to meet targets can result in forfeiture of bonuses or reduced stock option value.

The Process for Setting Executive Compensation Levels

Setting executive compensation levels typically involves a multi-step process. It begins with a thorough market analysis to determine competitive salary ranges for similar roles in comparable companies. This analysis considers factors such as company size, industry, geographic location, and the executive’s experience and qualifications. Next, the compensation committee of the board of directors, typically composed of independent directors, reviews the market data and considers the company’s financial performance and strategic goals. The committee then proposes a compensation package to the full board for approval. This package usually includes a base salary, annual bonuses, long-term incentives, and benefits. The entire process is documented and subject to regular review and adjustment.

Examples of Different Compensation Structures and Their Implications

Various compensation structures exist, each with its own implications. A purely salary-based structure provides stability but may lack the incentive for exceptional performance. Conversely, a heavily performance-based structure, relying primarily on bonuses and stock options, can incentivize risk-taking, potentially at the expense of long-term stability. A balanced approach, incorporating a base salary with performance-based bonuses and long-term incentives, is often preferred. For example, a CEO might receive a base salary, an annual bonus tied to achieving revenue targets, and stock options that vest over several years, encouraging a long-term perspective. This mixed approach balances risk and reward, fostering a culture of both short-term and long-term success.

The Role of Compensation Committees in Overseeing Executive Compensation

Compensation committees play a vital role in overseeing executive compensation. They are responsible for developing and recommending compensation plans, ensuring that these plans are aligned with company performance and market practices, and monitoring the effectiveness of the plans. The committee typically consists of independent directors who possess expertise in finance and compensation. They conduct thorough research, consult with compensation consultants, and engage in robust discussions to determine fair and appropriate compensation levels. Their oversight ensures transparency, accountability, and adherence to best practices, ultimately contributing to good corporate governance.

Shareholder Rights and Activism

Shareholders, as owners of a company, possess fundamental rights that enable them to participate in corporate governance and influence its direction. These rights, while varying slightly depending on jurisdiction and company bylaws, fundamentally grant shareholders a voice in the company’s operations and strategic decisions. The exercise of these rights, often amplified through shareholder activism, plays a crucial role in promoting good corporate governance practices.

Shareholder rights are a cornerstone of effective corporate governance, ensuring accountability and transparency. Understanding these rights and the mechanisms for their exercise empowers shareholders to actively participate in shaping their company’s future. Conversely, neglecting these rights can lead to a less responsive and potentially less successful enterprise.

Shareholder Rights

Shareholders typically have the right to vote on major corporate decisions, such as electing board members, approving mergers and acquisitions, and authorizing significant capital expenditures. They also have the right to receive regular financial reports, access company records (subject to certain limitations), and bring legal action against the company or its directors for breaches of fiduciary duty. Furthermore, shareholders have the right to sell their shares, albeit subject to market conditions and any restrictions imposed by the company’s articles of association. These rights, collectively, provide a framework for shareholder participation in the corporate governance process.

Shareholder Activism

Shareholder activism involves shareholders using their rights to influence a company’s strategic direction, corporate governance practices, and social responsibility initiatives. This can range from engaging in dialogue with management and the board to filing shareholder proposals, launching proxy fights to replace directors, or even pursuing legal action. Activist shareholders often target companies perceived as underperforming, lacking in transparency, or engaging in practices detrimental to shareholder value or broader societal interests. The goal is to improve corporate governance, enhance shareholder returns, and promote responsible business conduct.

Mechanisms for Shareholder Engagement and Communication

Effective communication between shareholders and the company is vital for fostering a productive relationship. Companies typically utilize various channels, including annual general meetings (AGMs), investor relations websites, direct mail communications, and dedicated investor hotlines. Many companies also actively engage with institutional investors and proxy advisory firms to understand shareholder concerns and expectations. The quality and frequency of this communication significantly impact the effectiveness of shareholder engagement. Companies that proactively and transparently engage with shareholders are often better positioned to address concerns and build trust.

Examples of Successful Shareholder Activism Initiatives

Numerous instances showcase the impact of shareholder activism. For example, shareholder pressure has led to significant changes in executive compensation practices in many companies, promoting greater alignment between executive pay and company performance. Similarly, activist shareholders have successfully pushed for greater board diversity, improved environmental, social, and governance (ESG) disclosures, and the adoption of more sustainable business practices. In some cases, activist campaigns have resulted in significant changes in a company’s strategy, leading to improved financial performance and increased shareholder value. The success of these initiatives highlights the power of shareholder activism in driving positive change within corporations.

Summary of Shareholder Rights and Responsibilities

Shareholders have the right to vote, receive information, and bring legal action, but also bear the responsibility to act in an informed and responsible manner, considering the long-term interests of the company and its stakeholders.

Final Summary: Corporate Governance Strategy

Implementing a strong corporate governance strategy is not merely a compliance exercise; it’s a strategic imperative for sustainable growth and long-term value creation. By fostering transparency, accountability, and ethical conduct, organizations can build trust with stakeholders, attract investment, and enhance their reputation. This guide provides a foundational understanding of the key elements involved, empowering organizations to develop and implement a tailored strategy that aligns with their unique needs and objectives. Continuous monitoring and adaptation are crucial to ensure the strategy remains effective in a dynamic business environment.