Pricing strategy analysis is crucial for business success. A well-defined pricing strategy directly impacts profitability, market share, and overall competitiveness. This analysis delves into the multifaceted aspects of pricing, from understanding market dynamics and cost structures to implementing and monitoring effective pricing models. We will explore various strategies, including value-based, cost-plus, and competitive pricing, examining their strengths and weaknesses in different market contexts. Ultimately, the goal is to develop a pricing strategy that aligns perfectly with business objectives and maximizes long-term value.

This guide provides a structured approach to analyzing pricing strategies, covering key areas such as market research, cost analysis, value proposition development, competitive analysis, pricing model selection, and the crucial aspect of price elasticity of demand. By understanding these elements, businesses can make informed decisions to optimize their pricing strategies and achieve sustainable growth.

Defining the Market Landscape

Understanding the market landscape is crucial for developing a successful pricing strategy. This involves a thorough analysis of the target market, competitive landscape, and prevailing market trends. By carefully considering these factors, businesses can optimize their pricing to maximize profitability and market share.

The target market for a product or service significantly influences pricing decisions. A luxury good targeting high-income earners will naturally command higher prices than a mass-market product aimed at budget-conscious consumers. Understanding the target market’s demographics, psychographics, purchasing power, and price sensitivity is essential for effective pricing.

Analyzing pricing strategies requires a nuanced understanding of market dynamics and competitor actions. However, a crucial element often overlooked is the direct impact on the customer experience; a strong pricing strategy should complement a well-defined Customer experience strategy. Ultimately, pricing decisions, when aligned with customer perceptions of value, can significantly influence brand loyalty and overall profitability.

Target Market Definition

Let’s consider a hypothetical example: a new line of organic, fair-trade coffee. The target market for this product would likely include environmentally conscious consumers, individuals with a higher disposable income willing to pay a premium for ethically sourced products, and coffee aficionados who appreciate high-quality beans. This understanding informs pricing decisions, allowing for a premium price point justified by the product’s unique attributes and the target market’s willingness to pay.

Competitor Analysis and Pricing Strategies

Identifying key competitors and analyzing their pricing strategies is another critical aspect of defining the market landscape. This involves researching competitors’ product offerings, pricing models, and overall market positioning. This analysis will reveal opportunities to differentiate your product and establish a competitive pricing strategy.

Effective pricing strategy analysis requires a nuanced understanding of market dynamics and consumer behavior. However, successful pricing also hinges on strict adherence to relevant regulations, which is where understanding E-commerce legal compliance becomes crucial. Failure to comply can lead to significant penalties, undermining even the most well-crafted pricing strategy. Therefore, a thorough legal review is an essential component of any robust pricing model.

Market Trend Analysis and Impact on Pricing

Market trends, such as inflation, economic downturns, or shifts in consumer preferences, significantly impact pricing decisions. For instance, during periods of high inflation, businesses may need to adjust their prices upward to maintain profitability. Conversely, during economic downturns, businesses may need to offer discounts or promotions to stimulate demand. Analyzing these trends allows for proactive adjustments to the pricing strategy, mitigating potential risks and capitalizing on emerging opportunities. For example, the growing popularity of sustainable products creates an opportunity for premium pricing, while increasing competition may necessitate a more aggressive pricing approach.

Competitor Pricing Comparison

The following table compares the pricing models of three hypothetical competitors in the organic coffee market:

| Price (per lb) | Features | Target Audience | Perceived Value |

|---|---|---|---|

| $15 | Single-origin, ethically sourced, organic | Affluent consumers, coffee connoisseurs | High quality, ethical sourcing |

| $12 | Blend of organic beans, fair-trade certified | Environmentally conscious consumers, value-seeking coffee drinkers | Good quality, ethical and sustainable |

| $9 | Organic blend, widely available | Price-sensitive consumers | Good value for money |

Cost Analysis

Understanding the cost structure of a product or service is crucial for developing a successful pricing strategy. Accurate cost analysis allows businesses to determine profitability, identify areas for cost reduction, and ultimately set prices that are both competitive and profitable. This section details the direct and indirect costs associated with a hypothetical example – a small bakery producing custom cakes.

Direct Costs

Direct costs are those directly attributable to the production of a good or service. For our bakery, these include the raw materials used in cake production.

- Flour, sugar, eggs, butter, and other baking ingredients: These are the primary components of the cakes and vary depending on the customer’s order.

- Decorations: Icing, fondant, sprinkles, and other decorative elements add to the cost and are directly tied to the specific cake design.

- Packaging: Boxes and ribbons used to present the finished cakes.

Indirect Costs

Indirect costs, also known as overhead costs, are not directly tied to a specific product but are necessary for the business to operate. These costs support the production process but aren’t directly included in the cost of each individual cake.

- Rent for the bakery premises: This covers the space used for baking and operations.

- Utilities: Electricity, gas, and water are essential for baking and maintaining the facility.

- Salaries of bakers and other staff: Labor costs are a significant component of indirect expenses.

- Marketing and advertising: Costs associated with attracting new customers.

- Insurance and licenses: Necessary for legal operation of the business.

Cost of Goods Sold (COGS) Calculation

The cost of goods sold (COGS) represents the direct costs associated with producing the goods sold during a specific period. For the bakery, COGS is calculated by summing up the cost of all the direct materials used in the cakes sold during that period. This includes the cost of ingredients, decorations, and packaging. For example, if the bakery sold 100 cakes in a month, and the average direct cost per cake was $20, the COGS for that month would be $2000. More sophisticated methods, such as FIFO (First-In, First-Out) or weighted-average costing, might be employed for larger businesses with complex inventory management.

Fixed and Variable Costs

Costs are categorized as either fixed or variable based on their relationship to production volume.

- Fixed Costs: These remain constant regardless of the number of cakes produced. Examples for the bakery include rent, salaries (assuming fixed salaries), and insurance.

- Variable Costs: These fluctuate directly with the production volume. For the bakery, variable costs include the cost of ingredients, decorations, and packaging – these increase as more cakes are produced.

Cost Structure Visualization

A pie chart depicting the bakery’s cost structure would show a segmented circle. A large segment would represent direct costs (e.g., 40%), encompassing ingredients, decorations, and packaging. Another significant segment would represent indirect costs (e.g., 60%), which include rent, utilities, salaries, marketing, and insurance. The specific percentages would depend on the bakery’s operational expenses and pricing strategies. The remaining small segments would represent other minor costs.

Value-Based Pricing

Value-based pricing centers on the perceived worth a customer places on a product or service, rather than solely on production costs. This approach recognizes that customers are willing to pay more for products or services that deliver significant value, solve a critical problem, or enhance their lives in a meaningful way. Understanding this perceived value is crucial for setting a price that maximizes profitability while maintaining customer satisfaction.

Value-based pricing requires a deep understanding of the customer’s needs, preferences, and willingness to pay. It involves carefully analyzing the benefits the product or service offers and translating those benefits into a monetary value. This contrasts sharply with cost-plus pricing, where the price is determined by adding a markup to the cost of production.

Defining Perceived Value

Perceived value is subjective and depends on several factors, including the customer’s individual needs, the perceived quality of the product or service, the competitive landscape, and the overall brand image. For example, a premium coffee brand might command a higher price than a generic brand due to its perceived superior quality, unique taste profile, and brand association with luxury and sophistication. Customers are willing to pay a premium for the experience and the status associated with the brand. This perceived value translates directly into the price a customer is willing to pay.

Comparing Value Propositions and Pricing Tiers

Different value propositions can support different pricing tiers. Consider a software-as-a-service (SaaS) company offering three tiers: Basic, Premium, and Enterprise. The Basic tier might offer core functionalities at a lower price point, targeting budget-conscious users. The Premium tier adds advanced features and increased storage capacity, appealing to users needing more robust capabilities. Finally, the Enterprise tier provides dedicated support, custom integrations, and higher usage limits, justifying a significantly higher price point for large organizations with complex needs. This tiered approach allows the company to cater to a broader customer base while maximizing revenue from each segment.

Determining a Price that Reflects Value

Determining the optimal price that reflects the value offered is an iterative process. It often involves market research, competitive analysis, and a thorough understanding of the customer’s willingness to pay. One approach is to conduct surveys or focus groups to gauge customer perceptions of value and their price sensitivity. A/B testing different price points can also provide valuable insights. Ultimately, the goal is to find a price point that balances profitability with customer acceptance.

Features and Their Perceived Value

The following list illustrates how individual features contribute to the overall perceived value of a product:

- Feature: High-quality materials. Perceived Value: Durability, longevity, premium feel.

- Feature: Exclusive design. Perceived Value: Uniqueness, status, style.

- Feature: Exceptional customer service. Perceived Value: Peace of mind, problem resolution, personalized support.

- Feature: Advanced technology. Perceived Value: Efficiency, innovation, improved performance.

- Feature: Brand reputation. Perceived Value: Trust, reliability, quality assurance.

Competitive Pricing Strategies

Understanding how competitors price their products is crucial for developing a successful pricing strategy. Ignoring the competitive landscape can lead to pricing that’s either too high, losing customers to cheaper alternatives, or too low, resulting in insufficient profit margins. This section will explore various competitive pricing strategies, their advantages and disadvantages, and provide examples to illustrate their application.

Cost-Plus, Value-Based, and Competitive Pricing: A Comparison

Cost-plus pricing, value-based pricing, and competitive pricing represent three distinct approaches to setting prices. Cost-plus pricing adds a markup to the cost of goods sold, providing a simple method but potentially ignoring market demand. Value-based pricing focuses on the perceived value to the customer, leading to potentially higher margins but requiring thorough market research. Competitive pricing aligns prices with those of competitors, offering a straightforward approach but potentially sacrificing profit margins or underestimating the value proposition. The optimal approach often involves a combination of these methods, tailoring the strategy to the specific product, market, and competitive landscape.

Competitive Pricing Strategies: Examples and Analysis

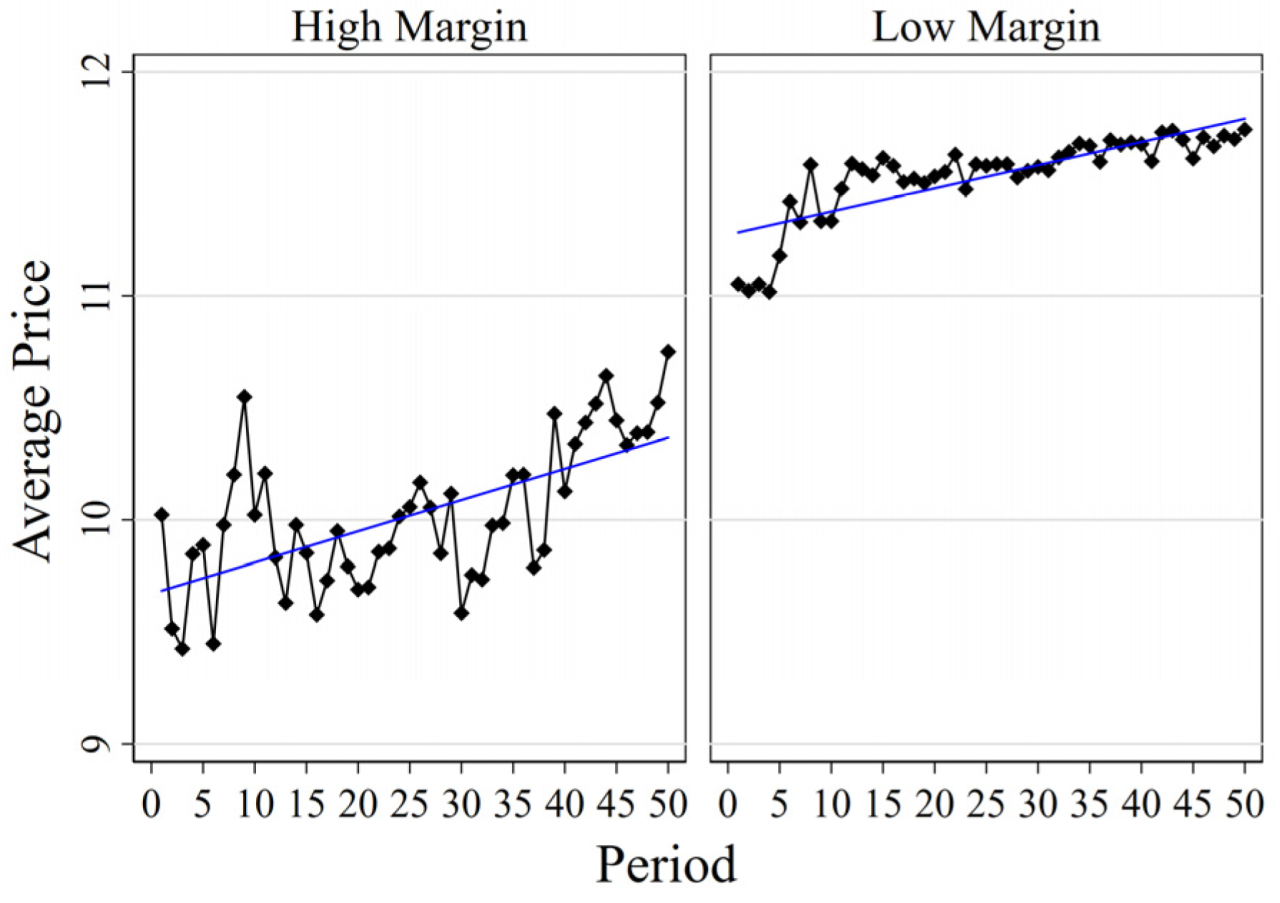

Three common competitive pricing strategies are price leadership, price skimming, and penetration pricing. Price leadership involves setting prices to match or slightly undercut the market leader, benefiting from established brand recognition and market share. This strategy can be advantageous in stable markets with established brand loyalty but risks price wars if the leader changes strategy. Price skimming involves setting a high initial price to capture early adopters and maximize profits before gradually reducing the price as competition increases. This works well for innovative products with limited initial competition, but is vulnerable to competitors entering the market with lower prices. Penetration pricing involves setting a low initial price to quickly gain market share, then potentially raising prices later. This strategy is suitable for highly competitive markets with price-sensitive customers, but requires a high sales volume to offset low initial margins and may not be sustainable in the long run.

Suitable Competitive Pricing Strategy for Specific Market Conditions

The choice of competitive pricing strategy depends heavily on factors such as market size, competition intensity, product differentiation, and customer price sensitivity. For example, a new, innovative product in a niche market might benefit from price skimming, while a commodity product in a highly competitive market might require penetration pricing. A company with a strong brand and established market leadership might employ a price leadership strategy. Consider a market with a dominant player and several smaller competitors. The smaller players might opt for competitive pricing, aligning their prices closely with the leader to remain competitive. Conversely, a new entrant might choose penetration pricing to quickly gain traction, even at the expense of lower profit margins initially.

Examples of Successful and Unsuccessful Competitive Pricing Strategies

Apple’s initial pricing of the iPhone exemplifies successful price skimming. By setting a high initial price, Apple positioned the iPhone as a premium product and captured a significant portion of the early adopter market. Conversely, some companies attempting to compete with established brands through aggressive penetration pricing have found their low margins unsustainable, forcing them to exit the market or raise prices, damaging their brand image. The success of a competitive pricing strategy is not solely determined by the strategy itself but by its alignment with the overall business strategy, marketing efforts, and the broader market context. A poorly executed price leadership strategy, for example, could lead to a price war that erodes profit margins for all participants.

Pricing Model Selection

Choosing the right pricing model is crucial for business success. It directly impacts revenue generation, market positioning, and overall profitability. A well-defined pricing model should align with the company’s strategic goals, target audience, and the competitive landscape. This section explores various pricing models and Artikels a process for selecting the most suitable option.

Several pricing models exist, each with its own strengths and weaknesses. The optimal choice depends heavily on the specific product or service, the target market, and the overall business strategy. Understanding these nuances is critical to making an informed decision.

Premium Pricing Model

Premium pricing involves setting prices significantly higher than competitors. This strategy is typically employed for products or services perceived as superior in quality, features, or brand reputation. Luxury goods often utilize this approach, relying on exclusivity and perceived value to justify the higher price point. A successful premium pricing model necessitates a strong brand identity and a clear differentiation from competitors. The higher price point can also contribute to a perception of higher quality and exclusivity, potentially attracting a more discerning customer base. However, it requires a significant investment in marketing and brand building to effectively communicate the product’s value proposition.

Economy Pricing Model

In contrast to premium pricing, the economy pricing model focuses on offering the lowest price possible. This strategy often involves minimizing costs and features to maintain a competitive edge in price-sensitive markets. Economy models typically target price-conscious consumers who prioritize affordability over advanced features or high quality. Successful implementation requires careful cost management and efficient production processes to maintain profitability despite the lower margins. However, it can lead to a perception of lower quality and may limit brand image growth.

Freemium Pricing Model

The freemium model offers a basic version of a product or service for free, while charging for premium features or access to advanced functionalities. This strategy aims to attract a large user base with the free offering, then converting a subset of users to paying customers. Successful freemium models often rely on network effects, where the value of the product increases with the number of users. Examples include popular software applications and online games. Careful consideration must be given to the balance between the free and paid offerings, ensuring the free version provides enough value to attract users while still incentivizing upgrades to the paid version.

Designing a Pricing Model: Example

Let’s assume we’re launching a new project management software. Our analysis shows a market segment willing to pay a premium for advanced features and robust security, and another segment focused primarily on affordability. Therefore, a hybrid model incorporating both premium and economy tiers seems appropriate.

Chosen Pricing Model Justification

We propose a tiered pricing model incorporating both premium and economy options. This approach allows us to cater to a broader market segment, maximizing revenue potential. The premium tier targets businesses with high security and collaboration needs, justifying a higher price point through advanced features and dedicated support. The economy tier caters to individuals and smaller businesses with more basic needs, focusing on affordability and essential functionalities. This strategy balances revenue generation from high-paying customers with market penetration among price-sensitive users. This strategy, while potentially leading to a slightly lower average revenue per user (ARPU) compared to a purely premium model, allows for significant market share expansion and a larger overall revenue stream.

Pricing Tiers

| Tier Name | Price | Included Features | Target Customer |

|---|---|---|---|

| Basic | $9/month | Basic project management tools, limited user access, basic reporting | Individuals, small teams, budget-conscious businesses |

| Pro | $29/month | All Basic features + advanced collaboration tools, increased user access, enhanced reporting, priority support | Small to medium-sized businesses, teams requiring robust collaboration |

| Enterprise | $99/month | All Pro features + custom branding, dedicated account manager, advanced security features, enterprise-grade integrations | Large enterprises with complex project management needs |

Price Elasticity of Demand: Pricing Strategy Analysis

Price elasticity of demand is a crucial concept in pricing strategy. It measures the responsiveness of the quantity demanded of a good or service to a change in its price. Understanding this relationship allows businesses to make informed decisions about pricing to maximize revenue and profitability. A thorough grasp of price elasticity informs effective pricing strategies and allows for better prediction of market reactions to price adjustments.

Price elasticity of demand is calculated as the percentage change in quantity demanded divided by the percentage change in price. A negative value indicates an inverse relationship (as price increases, quantity demanded decreases), which is typical for most goods. The magnitude of the elasticity value indicates the strength of the relationship.

Calculating Price Elasticity of Demand

Price elasticity of demand is calculated using the following formula:

Price Elasticity of Demand = (% Change in Quantity Demanded) / (% Change in Price)

Calculating the percentage change involves using the midpoint method to avoid inconsistencies depending on whether the price increase or decrease is used as the base. The midpoint method is calculated as: [(New Value – Old Value) / ((New Value + Old Value)/2)] * 100%. This method provides a more accurate and consistent measure of elasticity regardless of the direction of price change. For example, if the price of a product increases from $10 to $12 and the quantity demanded falls from 100 units to 80 units, the price elasticity of demand would be calculated as follows:

% Change in Quantity Demanded = [(80 – 100) / ((80 + 100)/2)] * 100% = -22.22%

% Change in Price = [(12 – 10) / ((12 + 10)/2)] * 100% = 9.09%

Price Elasticity of Demand = -22.22% / 9.09% = -2.44

This indicates that a 1% increase in price leads to a 2.44% decrease in quantity demanded. The absolute value is greater than 1, signifying that demand is elastic.

Interpreting Price Elasticity of Demand

The magnitude of the price elasticity coefficient provides valuable insights into the nature of demand.

* Elastic Demand (|E| > 1): A small percentage change in price results in a larger percentage change in quantity demanded. Revenue will decrease if prices are increased.

* Inelastic Demand (|E| < 1): A small percentage change in price results in a smaller percentage change in quantity demanded. Revenue will increase if prices are increased. * Unitary Elastic Demand (|E| = 1): Percentage change in price equals the percentage change in quantity demanded. Revenue remains unchanged with price changes. * Perfectly Elastic Demand (|E| = ∞): Any price increase leads to zero demand. * Perfectly Inelastic Demand (|E| = 0): Quantity demanded remains unchanged regardless of price changes.

Methods for Measuring Price Elasticity of Demand

Several methods can be employed to measure price elasticity of demand. These include analyzing historical sales data, conducting surveys to gauge consumer responsiveness to price changes, and using experimental approaches like A/B testing different price points. Analyzing historical sales data provides a cost-effective method for estimating price elasticity. Surveys offer insights into consumer perceptions and willingness to pay at different price points. A/B testing allows for controlled experimentation to measure the impact of price changes on sales. Each method offers unique advantages and limitations, and the best approach often depends on the specific context and available resources.

Using Price Elasticity Information to Optimize Pricing Strategies

Understanding price elasticity allows businesses to make data-driven pricing decisions. For products with elastic demand, small price increases can lead to significant revenue losses, suggesting a strategy of lower prices and higher sales volume might be more profitable. Conversely, for products with inelastic demand, price increases may lead to revenue gains, allowing for higher profit margins. Businesses should continuously monitor and reassess price elasticity as market conditions and consumer preferences evolve.

Examples of Products with High and Low Price Elasticity, Pricing strategy analysis

Luxury goods often exhibit high price elasticity. A small price increase can significantly reduce demand, as consumers are more sensitive to price changes in this category. Examples include high-end cars, designer clothing, and premium electronics. Conversely, essential goods like gasoline or prescription medications typically exhibit low price elasticity. Consumers are less sensitive to price changes for these necessities, even with price increases. The relative necessity of the good or service is a key factor influencing price elasticity.

Implementation and Monitoring

Implementing a chosen pricing strategy requires a well-defined plan and a commitment to ongoing monitoring and adjustment. Success hinges on careful execution and a willingness to adapt based on real-world market responses. This involves not only launching the new prices but also actively tracking their impact and making necessary changes.

The process of implementing a new pricing strategy begins with clear internal communication. All relevant departments, including sales, marketing, and customer service, must be informed of the changes and trained on how to handle customer inquiries related to the new pricing structure. This might involve new sales materials, updated FAQs, and revised training sessions. Simultaneously, the company should prepare for potential customer reactions, anticipating both positive and negative feedback. This proactive approach minimizes disruptions and allows for a smoother transition.

Implementing the Chosen Pricing Strategy

Implementation involves several key steps. First, a clear timeline should be established, outlining when price changes will take effect. Next, all systems, including inventory management, point-of-sale systems, and e-commerce platforms, must be updated to reflect the new prices. This requires meticulous attention to detail to avoid errors. Finally, a communication plan should be executed to inform customers of the price changes. This could involve email announcements, website updates, or in-store signage. For example, a company launching a value-based pricing strategy might highlight the improved quality or features justifying the price increase.

Monitoring the Effectiveness of the Pricing Strategy

Monitoring the pricing strategy’s effectiveness is crucial for its long-term success. This involves regularly tracking key performance indicators (KPIs) to assess the impact of the price changes on various aspects of the business. This continuous monitoring allows for timely adjustments and prevents the implementation of a strategy that ultimately harms the business. Regular reviews, perhaps weekly or monthly, should be scheduled to analyze the data and identify trends.

Adjusting the Pricing Strategy Based on Market Feedback and Performance Data

Based on the monitored KPIs, adjustments to the pricing strategy may be necessary. For instance, if sales volume drops significantly after a price increase, it might indicate that the price is too high and needs to be lowered. Conversely, if sales volume remains strong despite a price increase, it suggests the price could be further optimized for greater profitability. Market feedback, gathered through customer surveys, reviews, and social media monitoring, provides valuable qualitative insights to complement quantitative data from sales and revenue reports. For example, if negative customer reviews highlight a perceived lack of value for the price, a price reduction or a value-add might be considered.

Key Performance Indicators (KPIs)

The following table Artikels key performance indicators to track the success of the pricing strategy:

| KPI | Target Value | Measurement Method | Frequency of Measurement |

|---|---|---|---|

| Revenue | 15% increase year-over-year | Sales reports, financial statements | Monthly |

| Sales Volume | Maintain or increase by 5% | Sales reports, inventory data | Weekly |

| Average Order Value (AOV) | Increase by 10% | Sales reports, point-of-sale data | Monthly |

| Customer Acquisition Cost (CAC) | Decrease by 5% | Marketing campaign data, customer acquisition reports | Monthly |

| Customer Lifetime Value (CLTV) | Increase by 8% | Customer relationship management (CRM) data | Quarterly |

| Price Elasticity of Demand | -1.5 (indicating elastic demand) | Regression analysis of sales data and price changes | Quarterly |

| Customer Satisfaction (CSAT) | Above 4.5 out of 5 stars | Customer surveys, feedback forms | Monthly |

Wrap-Up

Effective pricing strategy analysis is not a one-time event but an ongoing process. Regular monitoring of key performance indicators (KPIs) and continuous adaptation to market changes are essential for maintaining a competitive edge. By systematically evaluating market trends, competitor actions, and internal cost structures, businesses can refine their pricing strategies to maximize revenue and achieve sustainable profitability. The insights gained from this analysis empower businesses to make data-driven decisions, leading to increased efficiency and a stronger market position.